If you have just got Ollo Platinum and Reward Card, pay attention. This article is for you. You can begin to use your credit card as soon as you are done with the activation process. www.ollocard.com/activate – Ollo Card Activation Guide

The activation process of Ollo card is quick and doesn’t waste time. It requires few steps in few minutes.

Ollo Card Activation Instructions

- Follow these steps to activate your Ollo card. as a card holder, you can activate your card with your home computer, mobile device, or smatphone.

- Visit ollocard.com/activate

- Enter your last name

- Enter your date of birth

- Click the last 4 digits of ssn

- Enter 16 digits of Ollo Card Number on your card or account statement

- Enter card expiration date mm/yy

- Click on the next button

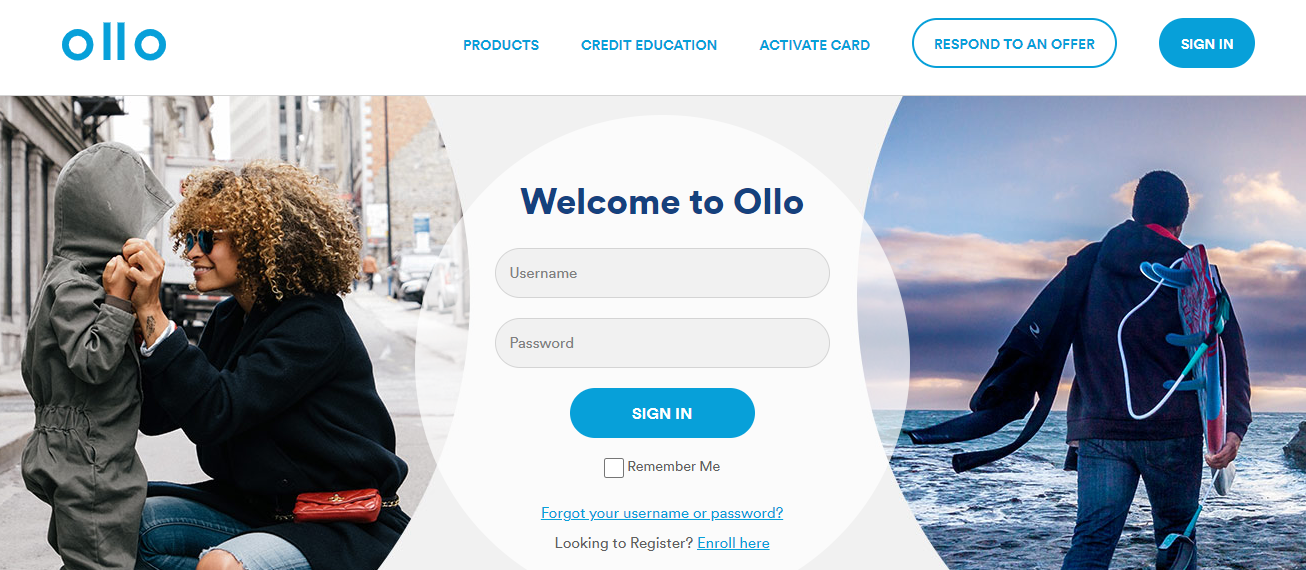

Enroll in Ollo Card Login Services

Now that you have activated your card, think of enrolling in the Ollo Card services. This is to enable you have access to your account and as well control it. This is the most convenient way to monitor your account activity. Therefore, you will not wait for billing statement every month.

Visit www.ollocard.com

Locate looking to register Enroll Here link

Complete the four step enrollment process. This requires the following details:

- Last name

- Date of birth

- Last 4 digits of your ssn

- 16 digit card number

- Card expiration date

- Create your login credentials

- Setup your security questions

Once done with the enrollment process, you can use your Ollo card login anytime. It will help you monitor the following information:

- Account balance

- Credit limit

- Recent/past transactions

- Account profile

- Make online payments

- View payment history

- Set up account alerts

You can setup your account for payments online. Add your bank account information. The reason for this is for manual and automatic online payments.

Ollo Platinum Card Features

- No annual fee

- No reward program

- Automatic credit line increase

- Free fico score available online

Ollo Rewards Card Features

- $39 annual fee

- Rewards program offers 2% cash back on gas station, grocery store and drug store purchase

- 1% cash back on all other purchases

- No over the limit fees

- Also, No returned payment fees

- No foreign transaction fees

- No rate hike when you make a late payment