In an evolving world, the method for working together is also evolving. With each person having constrained time, inside that he/she has to keep a reputation of their deals and costs, oversee and execute their field-tested strategy, work together gathering, etc. QuickBooks Payroll Technical Support Number makes that bustling timetable of bookkeeping application extremely easy to manage.

Payroll Employee Portal Experience – Intuit

https://workforce.intuit.com › app › ius › sign-in

Sign in Sign in · Security code · Enter your phone number, email or user ID · Phone, email or user ID · Email or user ID · Password.

Sign in – Let’s get you signed in – Payroll Employee Portal …

https://workforce.intuit.com › ius › account-recovery

Let’s get you signed in. Enter your phone number, email, or user ID and we’ll find your account.

Formerly PayCycle – Intuit

https://iop.intuit.com › login › login

Online Payroll for Small Business – Payroll Software and Payroll Services make employee … Please update your bookmarks. Are you an accountant? Sign�

About Intuit Payroll

Intuit is a Bookkeeping programming bundle that is designed and managed by Intuit. Intuit items are crafted for the most part for little and medium-sized organizations and offer on-premises bookkeeping applications just as cloud-based variants that acknowledge business installments, oversee as well as pay bills and payroll capacities.

QuickBooks Payroll For Employers

There is something new for employers. Intuit Online Payroll for mobile, is now QuickBooks Payroll. With a QuickBooks Online account. Employers can now run payroll, pay and file taxes, pay their employees. View up to a year’s worth of past checks, as well as view employee details, all from the app. This is now the best way of completing your payroll tasks while. You are away from your computer.

What can it help you do:

- Firstly, you get bank-level security

- Secondly, get free, expert payroll support

- With the payroll app, you can create accurate paychecks for your employees and contractors.

- E-pay taxes and e-file forms all in 50 states.

- Pay workers by free direct deposit

- Get timely reminders on upcoming payday and tax deadlines

- View past paychecks.

- The QuickBooks payroll for employers app syncs with QuickBooks Online Payroll, Intuit Online Payroll, Intuit Full Service Payroll, QuickBooks for Mac Payroll, and Intuit Online Payroll for Accounting Professionals.

Intuit Payroll Login Employee Service Number

Also, the Intuit payroll login employee service number is a site call, that makes it easy for managers to provide representatives with online access to their own check data. As of now, this offers you a simple entry of your compensation stubs, which implies, no more printing and mailing pay stubs each payday or having to deal with lost or harmed pay stubs. Now without much stress, they can sign into their View My Paycheck site and see any present or past pay stubs.

QuickBooks and Intuit Payroll Login

Employee

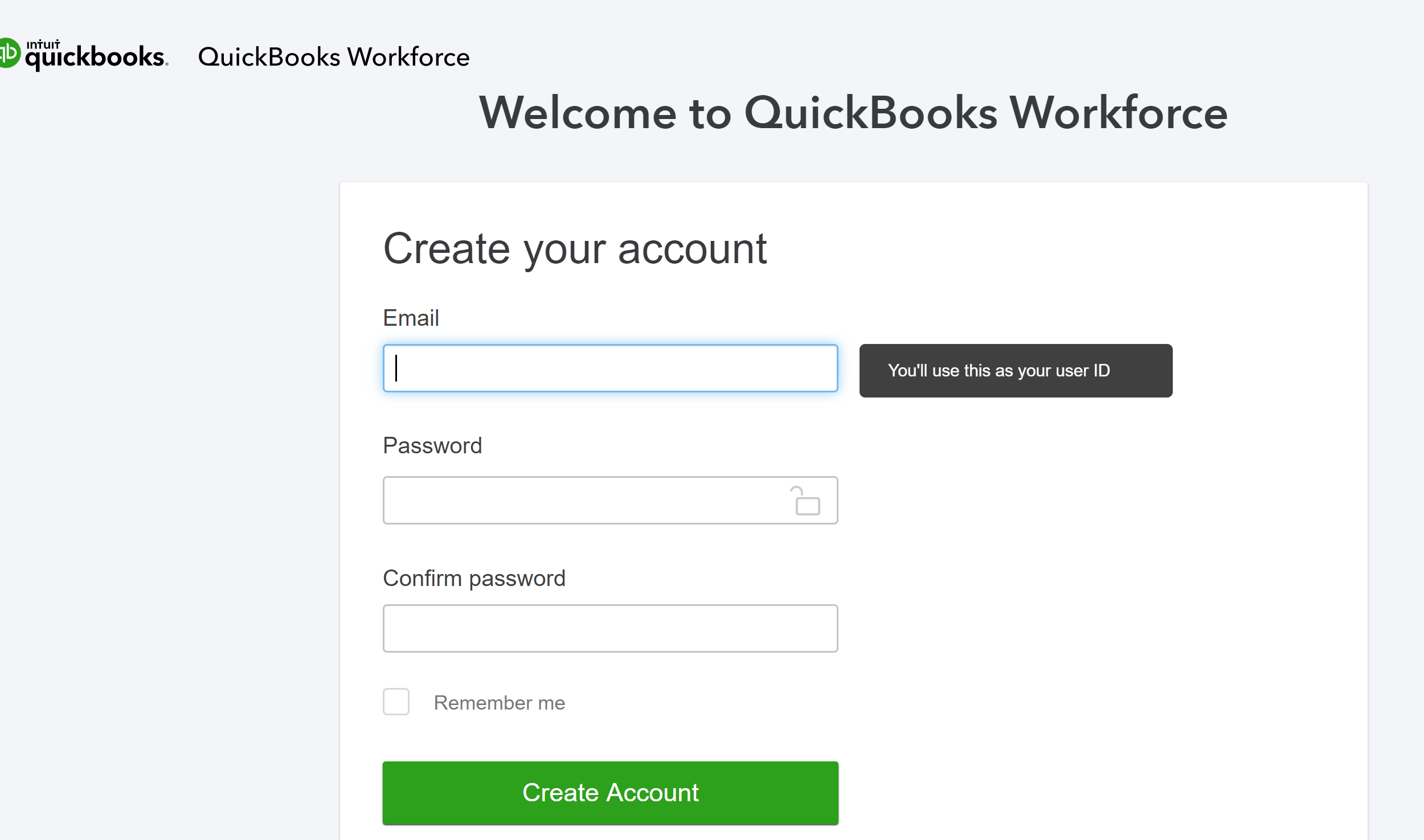

Lastly, for View My Paycheck, users have to join with the equivalent, to effectively run their finance in QuickBooks Desktop and afterward transfer the check data to their Intuit account Workers who are given the sign-in subtleties, to login to the site, where they can check their compensation stubs.