Do you know that you can earn up to 50,000 bonus points as a new member of the Marriott Rewards Premier Credit Card or Visa Signature Card? New cardholders can earn 50,000 points within their first 3 months of using the card if they spend up to $1,000 on purchases. The offer is only for new customers that are creditworthy. Apart from the 50,000 bonus points, new members also get a free night stay at a category 1-4 location available immediately after account opening. Customers also enjoy a free night stays annually on their account anniversary at a category 1-5 hotel. Have you seen that this credit card has a lot of benefits for its holders?

Marriott Bonvoy cards launch new welcome offers – CNBC

https://www.cnbc.com › select › marriott-bonvoy-cards…

Marriott Bonvoy Bold® Credit Card: You can earn 60,000 bonus points after you spend $2,000 in the first three months from account opening. The card comes ..

Last Chance To Score These Two Marriott Bonvoy Welcome …

https://www.cnbc.com › select › last-chance-to-score-th…

Marriott Bonvoy Bold Credit Card: Earn 60,000 points when you spend $2,000 within the first three months of card membership.

The best way to use a Marriott 50000-point free night certificate

https://www.businessinsider.com › … › Credit Cards

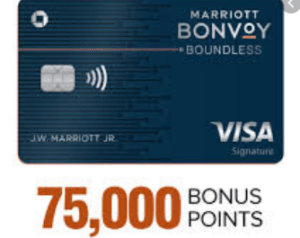

Earn 75,000 Marriott Bonvoy bonus points after you use your new Card to make $3,000 in purchases within the first 3 months. · Enjoy up to $300 in …

14 ways to redeem the Marriott 50k free night award – The …

https://thepointsguy.com › guide › best-marriott-50k-fr…

Plus, you’ll earn 10x total points on up to $2,500 in combined purchases at grocery stores, restaurants, and gas stations within the first 6 …

However, this Marriott Rewards Premier Credit Card is perfectly ideal for frequent travelers that make a lot of airline purchases, car rentals, dine out and as well lodge at Marriott Hotel. If you frequently travel and enjoy lodging at Marriott hotel, make sure to get this card and enjoy its benefits. The card`s rewards program is very enticing. Imagine earning 5 points for every $1 you spend over 3,800 Marriott locations in addition to Ritz Carlton. Cardholders also earn 2 points for every $1 they spend on airline tickets that they buy directly from the airline, car rental services, and restaurants. They as well get 1 point for every $1 they spend on making purchases in all other places.

Certain features of the Marriott Rewards Premier Credit Card

- There is a late payment fee of up to $15 if the balance is less than $100. $25 for balances between $100 AND $250 and $35 for balances above $250.

- $0 annual fee for the first year and $85 annual fees for the subsequent years.

- The APR is 99%.

Interestingly, cardholders get a fast track to the Marriott Rewards Elite status with so much ease. They earn one elite credit for every $3,000 they spend. Cardholders earn 15 credits after their account has been approved and after their account anniversary every year. For cardholders who want to fast-track and earn 7 free nights at a Category 1 hotel, they should do their 1 free night after their account has been approved. They should also make a $1,000 purchase to get their 50,000 bonus points within the first 3 months of account opening. The above makes 7 free nights at a Category 1 location.

Before applying for the card, go to the Marriott Rewards Premier Credit Card website to carefully review all the details of the card including its terms and conditions. This will help you decide to either apply for the card or not. If you are not a frequent traveler and do not lodge in Marriott hotel, it is best not to apply for it.