The American Express Rewards card

Benefits of using an Amex card with cash back

This card pays 1.25% of cash for expenses and an additional $ 50 loan only a few times. The Amex card is specially designed for people with good credits who want rewards cards and for those who prefer American Express from other options such as Visa and MasterCard.

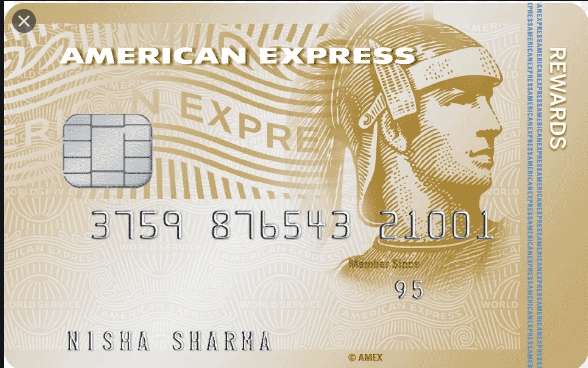

A view of the Amex card | The American Express Rewards card

The return of 1.25% on this card is one of the richest in the industry. You can earn an additional $ 50 on your account by spending $ 500 on retail purchases in the first 90 days.

The $ 50 buy-back threshold is much higher than other credit cards, and some do not have minimum exchange rates, but a high percentage of return is part of the difference.

This card also does not have a 5% return in terms of quarterly rotation. Instead, you get 25% more for all purchases and you do not have to change the way you spend money to get it.

The advantages of using the American Express rewards card

Points can be exchanged for 2,500 points and expire five years after the month in which they were earned. An easy way to get rewards is to use your credit card for daily purchases, such as food, gas and utility bills.

Card holders can also earn points for purchases and exchange rewards for trips, gift cards, cash and special events. The program contains rules for each category describing the benefits.

Here are some of the benefits and rewards that cardholders will receive:

Cardholders will receive high cash back rewards of 1.25%

$50 in bonus cash rewards are easily obtainable.

There is no annual fee.

No earnings limit.

There is a 1.25% cash-back rebate on spending.

Earn $50 statement credit if you spend $500 on retail purchases on the card within the first 90 days.

APRs

Credit certificates will generally apply to exist balances with an annual percentage rate (APR). Below is a guide about card fees:

0% for 12 months of purchases and transfers of successes within the first 60 days of account opening.

12.99% to 22.99% after the introductory period.

Cash Advance APR is 22.99% or 24.99% depending on the type of cash transaction.

APR sanctions: up to 29.99%.

Charges

Balance transfer Fee: 10 or 4%.

Fee for foreign transactions: 1%.

Late payment: up to $35

Returned payment fee Fee: up to $ 25.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest