A balance transfer typically involves shifting the debt on one credit card onto another. This is because the new card offers a 0 percent or low introductory interest rate on balance transfers. With this, you’re getting a chance to pay down the debt at a lower rate than you had with the old card.

Best Balance Transfer Cards of November 2021 | Credit Karma

https://www.creditkarma.com › credit-cards › balance-tr…

Hear from our editors: The best balance transfer cards of November 2021 · Best for long 0% intro APR: U.S. Bank Visa® Platinum Card · Best for people who might …

How Do Credit Card Balance Transfers Work? – Investopedia

https://www.investopedia.com › credit-cards › balance-t...

The challenge: Transferring a balance means carrying a monthly balance and carrying a monthly balance (even one with a 0% interest rate) still …

Best Balance Transfer 0% APR Credit Cards of November 2021

https://www.bankrate.com › finance › balance-transfer

A balance transfer involves moving debt from one credit account to a different account, typically by using a balance transfer credit card that …

Balance Transfer Credit Cards | Mastercard

https://www.mastercard.us › categories › balance-transfers

Looking for credit cards with no balance transfer fees or 0% interest on balance transfers? Check out these Mastercard credit cards & find the right one …

Regular APR:�13.99% – 23.99% (Variable)

Annual Fee:�$0

Best Balance Transfer Credit Cards Of November 2021 – Forbes

https://www.forbes.com › advisor › balance-transfer

Oct 29, 2021 — A balance transfer lets you save on existing high-interest debt by transferring your balance to a card with a lower interest rate or one with a …

Pros And Cons Of Balance Transfer Credit Cards – Forbes

https://www.forbes.com › advisor › the-pros-and-cons-…

A balance transfer moves debt from one account or credit card to another. Ideally, the shift is made to an account or card with either an …

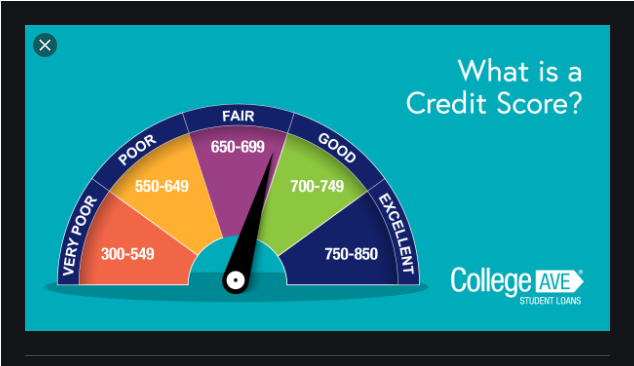

Does balance transfer itself affect or impact your credit score?

Hard inquiry

A new card implies a hard inquiry into your credit, which could lower your score, at least for a short time.

Credit limit

If you are increasing your credit limit in the course of the balance transfer and using less of your credit card, this could bring down your credit utilization rate. Understand that bringing down that rate could increase your score.

Age of your credit accounts

Since a balance transfer means a new account, you’ll be decreasing the average age of your credit history. This new card does not have a payment history yet. This could decrease your score slightly.

Payments on the new card

When you take advantage of a balance transfer offer and start diligently paying down your debt, you may be able to save money and possibly improve your credit score simultaneously. Making on-time payments going forward could lead to your score rising.

Would a Balance Transfer Improve My Credit

Having multiple debts moved to a single balance transfer credit card. Could decrease your overall credit utilization rate. Or the percentage of available credit that you are using. This means, that the lower your credit utilization. The better because a low rate helps lenders. Know that you are not accumulating debt that you can’t repay. Experts advised keeping your credit utilization below. 30% at all times, which means using no more than 30% of your credit limit at any point.

If you have multiple credit accounts but move their balances to a single account via a balance transfer, your former accounts’ utilization rates will appear as 0% on your credit report. This could lower your average utilization, which accounts for 30% of your FICO® Score, which is the score mostly used by lenders.

Some credit scoring models are known to calculate credit utilization depending on individual credit cards. When this happens, your new balance transfer card may have a high utilization rate, since it now incorporates all the balances that you have transferred from previous accounts. This could have a negative impact on your utilization rate.

How to do a Balance Transfers Without Hurting Your Credit

To do balance transfers while keeping your credit intact, use these simple guidelines:

Apply only for the card that will best fit your needs

It is not easy to know how high a credit limit an. Issuer will offer you if approved for a balance transfer card. However, it is best to avoid hedging your bets by applying for more than. One balance transfer card at a time. Even though you can’t predict a card’s potential credit limit, you can compare balance transfer cards depending on how long they offer 0% APRs, as well as other factors.

Avoid transferring a balance up to the new card’s full credit limit

When you transfer a balance that either max out your new card or gives it a really high utilization rate, that could hurt your credit score. A maxed-out card can lower your score by 45 points, according to FICO.

Hold on until you’ve built up your credit history

If you already have a lengthy credit history of say, several credit cards or loans aged about three years or older a brand new account may not really have much impact on your score. However, if you’re getting charged an inordinately high APR on an existing card’s balance, you may be better served by doing a balance transfer irrespective of your credit history.

On the whole, the goal of getting a balance transfer card is to make it possible to pay off debt. When you take advantage of your 0% APR period and use your interest savings to pay down the balance, your credit utilization will overtime decrease. This will have the biggest impact on your credit score, as well as making all your debt payments on time.

A transfer balance credit card can have a negative impact on your credit in the short term. However, if appropriately used, it can be part of a strategy to improve your score generally. Thus, ensure you create a debt payoff plan, and follow through on it, to take advantage of the interest savings that a balance transfer can offer. Thus, you’ll not only experience the credit score benefits of debt freedom, but also the peace of mind that comes with it.

A balance transfer can hurt your credit score by increasing your single card utilization, decreasing your length of credit history, and adding a hard inquiry to your credit report. On the other hand, it can also boost your score by increasing your overall card utilization, as well as help you pay off debt faster

.Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest