Factors That Can Affect Your Credit Score

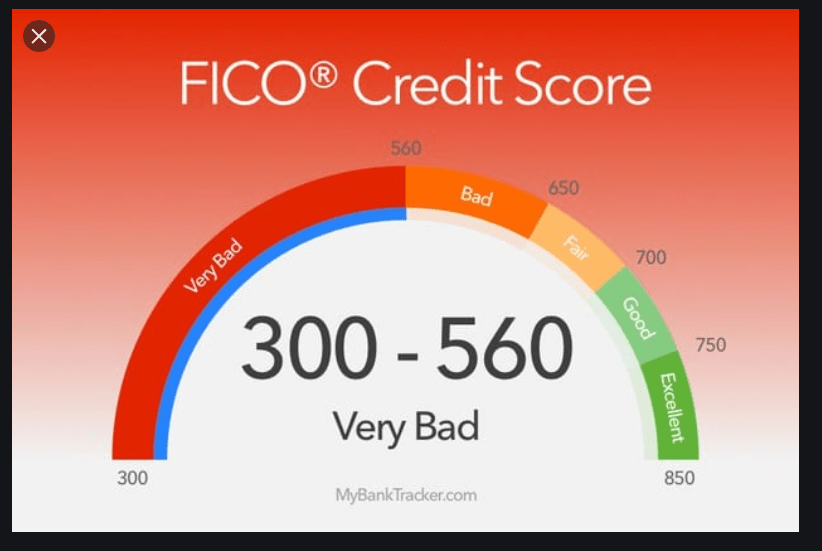

Your Credit score greatly affects your life now and in the future in an unexpected way. Your credit score determines the interest rate payable for credit cards and loans and helps lenders decide if you can be approved for a credit card or loan.

Companies like insurance companies now use your credit score to make decisions about you. Also, utility companies check your credit before creating a new service in your name and your credit history is been checked by some employers to enable them to determine if you can be given a job, a raise, or a promotion.

Building and safe guiding your credit score is essential, and also how you manage the following matters a lot.

What factors affect your credit scores?

https://www.creditkarma.com › Get More Advice

What factors affect your credit scores? · 1. Most important: Payment history · 2. Very important: Credit usage · 3. Somewhat important: Length of …

What Factors Affect Your Credit Scores? – NerdWallet

https://www.nerdwallet.com › Personal Finance

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you‘ve used credit.

5 Factors That Affect Your Credit Score – The Balance

https://www.thebalance.com › factors-affecting-credit-s…

Credit scoring calculations, such as the FICO score, look at a few key factors related to your debt. The amount of overall debt you carry, the ratio of your …

The 5 Biggest Factors That Affect Your Credit – Investopedia

https://www.investopedia.com › … › Building Credit

What Counts Toward Your Score — 1. Payment History: 35% … There is one key question lenders have on their minds when they give someone money: “Will I get it …

Bill Payment History.

Surprisingly, 35% of your credit score is determined by your payment history. How often you pay your bills to have an effect on your credit score more than anything. With payment issues such as; charge-offs, bankruptcy, collections, repossession, tax lien, or foreclosure, it can ruin your credit score, which is making it hard for you to be approved for that, it has to do with good credit.

What to do for your credit score is making your payments monthly and on time.

The Level of Your Debt Matters | Factors That Affect Your Credit Score

Your debt level on the order hand determines 30% of your credit score. Credit scoring calculators, such as the FICO score, see some key factors in line with your debt. The ratio of your credit card balance to your credit limit( or credit utilization), the relation of your loan balance to the original loan amount, and all the amount of debt you carry.

You are to keep your credit card utilization at 30% or less. That does not charge more than 30% of any card’s available limit.

Too much debt or a huge balance may affect your credit score greatly. But your credit score gets better quickly as you pay your balances.

Age of Your Credit History

The age of your credit is 15% of your credit score, considering both the age of your oldest and the mean age of all your accounts. Being in possession of an “older” credit age is good for your credit score due to the fact that it shows you have much experience managing credit.

Opening or closing an existing account can reduce your mean or average credit age. So do not open many new accounts at once.

The Credit Types on Your Report.

There are two types of credit accounts: installation loan and revolving account. If you have both types of accounts on your credit report, it is good, especially for your credit report score. As it indicates that you can successfully manage different types of credit.

You can have a loan from different types of assets, like a home or a car, added to your credit card and even a personal loan or Student Loan. Because 10% of your credit score is based on the types of credit, so make sure you have the necessary types of credit accounts to improve your score.

The Number Of Credit Inquiries Made

Whenever you send an application that needs a credit check, an inquiry that is 10% of your credit score is added to your credit report. A lot of inquiries, especially in a short time can reduce the points of your FICO score, but one or two will not. Therefore, you are advised to keep your application at a minimum to save your credit score.

Luckily, only the inquiries made in the last 12 months factors into your credit score, but this may vanish from your credit report after 24 months.

Also, checking your credit report results in a “soft” inquiry does not affect your credit score.