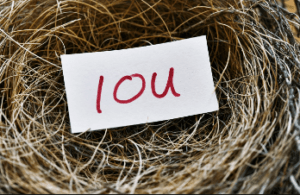

IOU

IOU – I Owe yoU, is simply a signed document that acknowledges a debt owed. It serves as an informal acknowledgment addressed to a creditor by the borrower about a debt of a specific sum.

Even though IOU started in the 18th century and as an informal. Written agreement rather than a legally-binding commitment, is still in use now.

What is an IOU? – HG.org

https://www.hg.org › legal-articles › what-is-an-iou-554…

An IOU is a document recording debt and an informal agreement typically to pay someone, though it can be to do something. Without memorializing the debt …

What Is an IOU? – The Balance

https://www.thebalance.com › what-is-an-iou-5202077

An “I owe you,” or IOU is an informal document that records the existence of a debt. Learn about IOUs, how they work, and how to increase

Free I Owe You (IOU) Template – PDF – eForms

https://eforms.com › Loan

Create Document. An IOU Form, “I Owe You”, is a written acknowledgment of debt to another party. An IOU is a simple solution when two parties want to record.

What is an IOU? | LawDistrict

https://www.lawdistrict.com › Legal Dictionary

How Do IOUs Work? — IOUs are the most basic of notes payable but in order to have any validity, they must contain a number of important details.

WHAT YOU SHOULD KNOW

- An IOU is a document written in acknowledgment of a debt.

- For a business transaction. It is advisable that the IOU is followed by a formal written contract.

- In bookkeeping, IOU is a term referred to as accounts receivable

The fact of the informality of IOU can be explained as. Uncertainty because it can be a binding contract where the legal. Remedies may be unfavorable to enforce unlike a formal contract like a bond indenture. This is a negotiable instrument because of its uncertainty.

We can predict a standard format that an IOU can take because not all may necessarily make use of some criteria such as time. Date, interest due, and payment type. As a result of the current template available for IOUs. It may be easier to maintain a streamline of criteria since it contains the. Outline of the kind of details that should be included.

However, most times an IOU is released at the heat of the. Business with the idea of a memorandum of intent and in line with. A businesslike written agreement.

IOUs in Bookkeeping

In bookkeeping, the keeper can account for outstanding debt as an IOU. This will be referred to as accounts receivable item and. Is placed as an asset on the balance sheet. Thus the state of the finance reflects. If it is due in less than a year on a year at the dot- this is a current asset as the case may be.

Receivable Exchange

Receivable Exchange is a platform (precisely an online market). Where companies eventually sell IOUs, especially IOUs that are formal and. Will be considered as a legal document or accounts receivable. Over here, the seller can decide or agree a discounted price in. Order to get immediate payment. Upon an agreed date will the buyer be paid the full amount?