What is Debit Balance?

A debit balance is the amount of money an investor owes on a margin loan. It is calculated as the amount the investor directly owes his/her broker. It does not account for the paper profit the investor has made on various transactions. When determining the amount owed in the case of a margin call. The adjusted balance is typically used. Which starts with the balance and subtracts the amount of applicable paper profit.

It occurs in a situation where an investor purchases securities on margin. Or borrows money from the account by using securities as collateral. Brokerage firms mostly charge an interest rate on the borrowed funds. This varies with the size of the balance.

It’s seen as simply what you owe. It is entered as accounts receivable on the books of the lender and is displayed on your account statement as a debt.

General Rules for Debits and Credits | Financial Accounting

General Rules for Debits and Credits | Financial Accounting

https://courses.lumenlearning.com › chapter › general-r…

Debit simply means left side; credit means right side. Remember the accounting equation? ASSETS = LIABILITIES + EQUITY The accounting equation must always be in …

Debits and Credits – Normal Balances – Accounting Coach

https://www.accountingcoach.com › explanation

Normal Balances, Revenues & Gains are Usually Credited, Expenses & Losses are Usually Debited, Permanent & Temporary Accounts.

Which accounts normally have debit balances?

https://www.accountingcoach.com › blog › debits-credits

The same entry will include a credit to its liability account Notes Payable since that account balance is also increasing. Free Debits and Credits Cheat Sheet.

Rules of Debit and Credit: Left versus Right – Accountingverse

https://www.accountingverse.com › accounting-basics

Hence, to increase an asset account, we debit it. To decrease an asset account, we credit. Liability and capital accounts normally have credit balances. To …

Debit vs. Credit: An Accounting Reference Guide (+Examples)

https://www.fool.com › the-blueprint › debit-vs-credit

Since we deposited funds in the amount of $250, we increased the balance in the cash account with a debit of $250.

Examples Include

Often found in the assets and expenses ledgers, and here are a few examples:

-

Fixed assets A/c’s

- firstly, When a fixed asset is bought, it is kept as a debit exchange, and later credit entries are made for charging run down of the asset. It leaves a net balance in the fixed asset account.

-

Expense A/c’s

- Secondly, is Expense and loss accounts like rent, salary, repair, interest expense, electricity, etc., always carry a balance.

-

Investments

- Thirdly, the investment purchased will have a debit entry, and later, the balance will be seen in the investment account.

Debit vs. Credit Balance

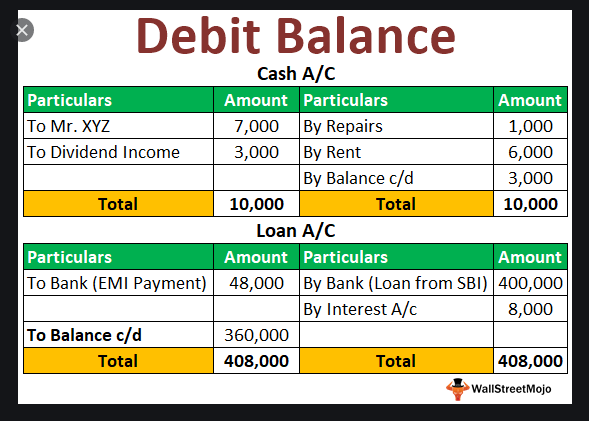

Furthermore, Two types of balances are found in the general ledger. In order to find out what balance a ledger reflects, you will have to check which side of the ledger has a higher balance, (i.e.) if the debit total is greater than the credit, then the ledger has a debit balance. However, if the credit total is higher than the debit total, then it will have a credit balance.

It is represented thus:

- If Debit Total > Credit Total = Debit Balance and

- If Credit Total >Debit Total = Credit Balance.

Adjusted Debit Balance

A margin account may consist of both long and short margin positions. This is an amount in a margin account that is owed to the brokerage firm, excluding profits on short sales and balances in a special memorandum account (SMA).

In a margin account, the brokerage customer is able to borrow funds from the brokerage firm, in order to buy securities and pledge cash or securities already in the margin account as collateral. The adjusted balance intimates the investor on how much would be owed to the broker in the event of a margin call, which needs to pay the borrowed funds to the brokerage firm.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest