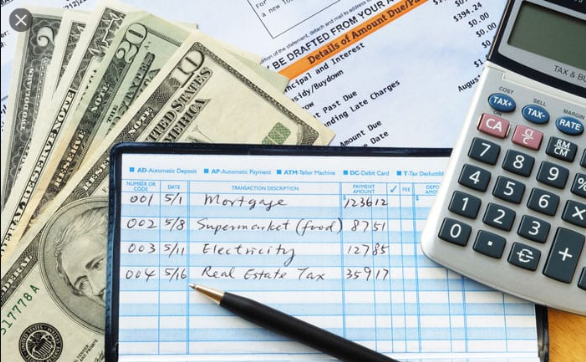

Basic Steps to Calculating Your Own Finance Charges

The credit card payment summary will always include finance charges. Knowing how to do the calculations yourself can be useful if you want to know what financial charges you expect from the balance of a particular credit card or whether you want to check if your account has been correctly settled.

To know how to calculate your finance charges, note that three figures associated with the credit card account: credit card balance, ARP and duration of the billing cycle.

A simple way to calculating your finance charges

The easiest way to calculate a financial tax is:

The monthly rate of the X balance | Basic Steps to Calculating Your Own Finance Charges

The monthly rate of the X balance | Basic Steps to Calculating Your Own Finance Charges

Let’s assume each billing cycle lasts for just a month and there are 12 billing cycles a year. Now you have a credit balance of $500 with an APR of 18%. First, you calculate the periodic rate by dividing the APR by the number of billing cycles in a year, which in our example is 12. Remember to convert the percentages to decimal. The periodic rate is:

.18 / 12 = 0.015 or 1.5%

The monthly finance charge is:

500 X .015 = $ 7.50

Shorter billing cycle Calculation | Basic Steps to Calculating Your Own Finance Charges

The billing cycle for the majority of credit cards available is shorter than a month, 23 or 25 days. If the number of days in the billing cycle is less than one month, the finance charges can be calculated as follows:

balance multiplied by APR multiplied by days in the billing cycle / 365

For instance: the billing cycle is 25 days, the finance charges for this billing period would be:

500 x .018 X 25/365 = $6.16

You will notice that the funding rate is lower, even if the balance and interest rate are the same. This is because you pay interest for less than 25 days compared to 31 days. The annual amount of fees paid to your account would be almost the same.

The final balance and previous methods of balance are easier to calculate. The financial charges are calculated based on the balance at the end or beginning of the billing cycle.

The adjusted balance method is a bit more complicated;

it takes over the balance at the beginning of the billing cycle and reduces payments made during the cycle.

The Daily balance method adds your finance charge for each day of the month.

To complete this personal calculation, you need to know the credit card balance accurately every day of the billing cycle. Then multiply your daily balance by the daily rate (APR / 365). Add a daily rate to get a monthly funding rate.

Credit card issuers often use the average daily balance method, which is similar to the daily balance method. The difference is that each day’s balance is averaged first and then the financial charges is calculated on the basis of the average.

You need to know your credit card balance at the end of each day to enable you do the calculation your self. Add your daily balance and then divide the number of days in the billing cycle. Then multiply the number by RAP and the days of the billing cycle. Divide the result by 365.

You may not have to pay for funding if you have a 0% interest rate or if you have paid the balance before the grace period.