Most of us have actually come across the word authorized transaction. Although this is the case, most have actually wondered if you could authorize transactions?. I also was in the same situation until I got enlightened. So my aim in writing this article is to help you find the answers you need. Here, we will help you will understand all about it and how it actually works.

So now let’s start with the basics and take it up from there.

What is an Authorized Transaction?

An authorized transaction (also known as card authorization) is a debit or credit term. This term is used for an authorized transaction that has been approved. It is the purchase, for which the merchant gets the go-ahead from the bank that issued the customer’s payment card.

Understanding Authorized Transaction

In understanding the said term, certain factors come into play. The authorized transaction is a component of the electronic payment process. Here, the cardholder and numerous other entities work together in a bid to complete an electronic transaction.

Let’s further break down the terms for a better understanding

Understanding ePayment Transactions – Oracle Help Center

https://docs.oracle.com › eng › lssf › concept_Understa…

Through real time or batch authorization, your system transfers the credit card number and payment request to the payment provider. The payment provider routes

Know Your Payments » Transaction Basics

http://www.knowyourpayments.com › transaction-basics

How is a transaction authorized and settled? When a consumer pays a merchant for goods and/or services, either online or in-store, the payment is initiated

Overview of How Payment Transaction Processing Works – FIS

https://www.fisglobal.com › insights › article › how-a-p…

Understand how payment transaction processing works with this quick overview of the approval, decline, and settlement. Learn about who is involved and what

Electronic Payment Systems – Payment Options

https://paymentoptionseps.com › blog

“Authorization, Only” transaction: Used to verify the authenticity of a credit card account, and that sufficient funds are available to make a …

Electronic Payment Transaction

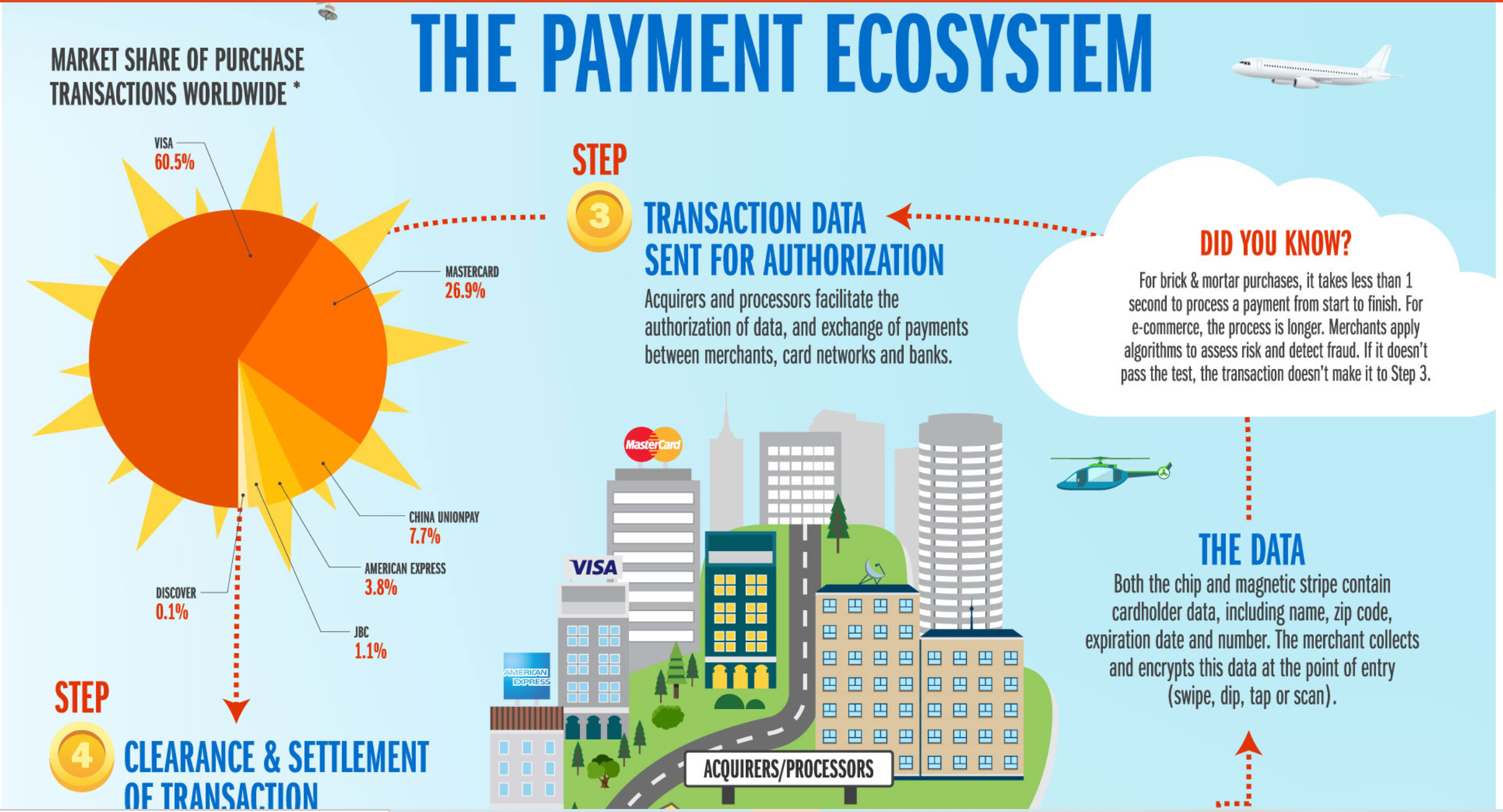

An electronic payment transaction consists of financial institutions, merchants, and payment processors. These parties are all part of the system that makes electronic payments feasible.

How Electronic Payment Transactions Work

The very first step begins with the cardholder. The cardholder seeks to make a payment with a payment card. Thereafter, the cardholder authorizes the payment by providing it to the merchant and presenting identification if required. A consumer then swipes his/her card through a card reader or keys in the card’s details in an online merchant’s checkout system. The payment system, in turn, sends the card’s details to the merchant’s bank. Note, that normally a payment card will require some information in order to start processing. This detail include a personal identification number, expiration date, zip code, or card security code.

After the card details have been keyed in, it is then sent to the merchant bank. The merchant bank acts as the lead facilitator on an electronic transaction. It works on behalf of the merchant in getting payment which is put in the merchant’s account. After the merchant bank receives the payment information, they use their payment network to send the payment details via the right channel.

Most merchant banks work with a network of processors. This allows the merchant to accepts an assortment of branded cards. It is the payment processor, that contacts the cardholder’s financial institution. The cardholder’s financial institution ensures that the cardholders have the funds in their account to meet up with the charge. After the issuing bank approves the charge, detail is sent by the processor to the merchant bank. The merchant bank then confirms the charge to the merchant.

In this network, the merchant bank stands as the final entity involved in the transaction. After the transaction has been confirmed to the merchant, it is said to be authorized. The merchant bank will, in turn, take steps in depositing the funds in the merchant account.

Declined Transactions

When a transaction cannot be authorized, it will be declined. Now, so many factors come to play when a card is declined. It could include the following reasons:

- When a cardholder does not have funds in his/her account to cover the transaction. Another reason is if the transaction would cause the cardholder to exceed the card’s credit limit.

- A card that has been reported lost or stolen.

- A counterfeit card.

- Mistake by a cardholder when entering credit card details.

- Using an expired card

- Due to a technical glitch

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest