12 tips for making purchases of cars with credit

It is important you know that your credit history plays an important role in approving the car loan and the cost of interest paid for financing the purchase.

Work on your credit before you go for car shopping | tips for making purchases of cars with credit

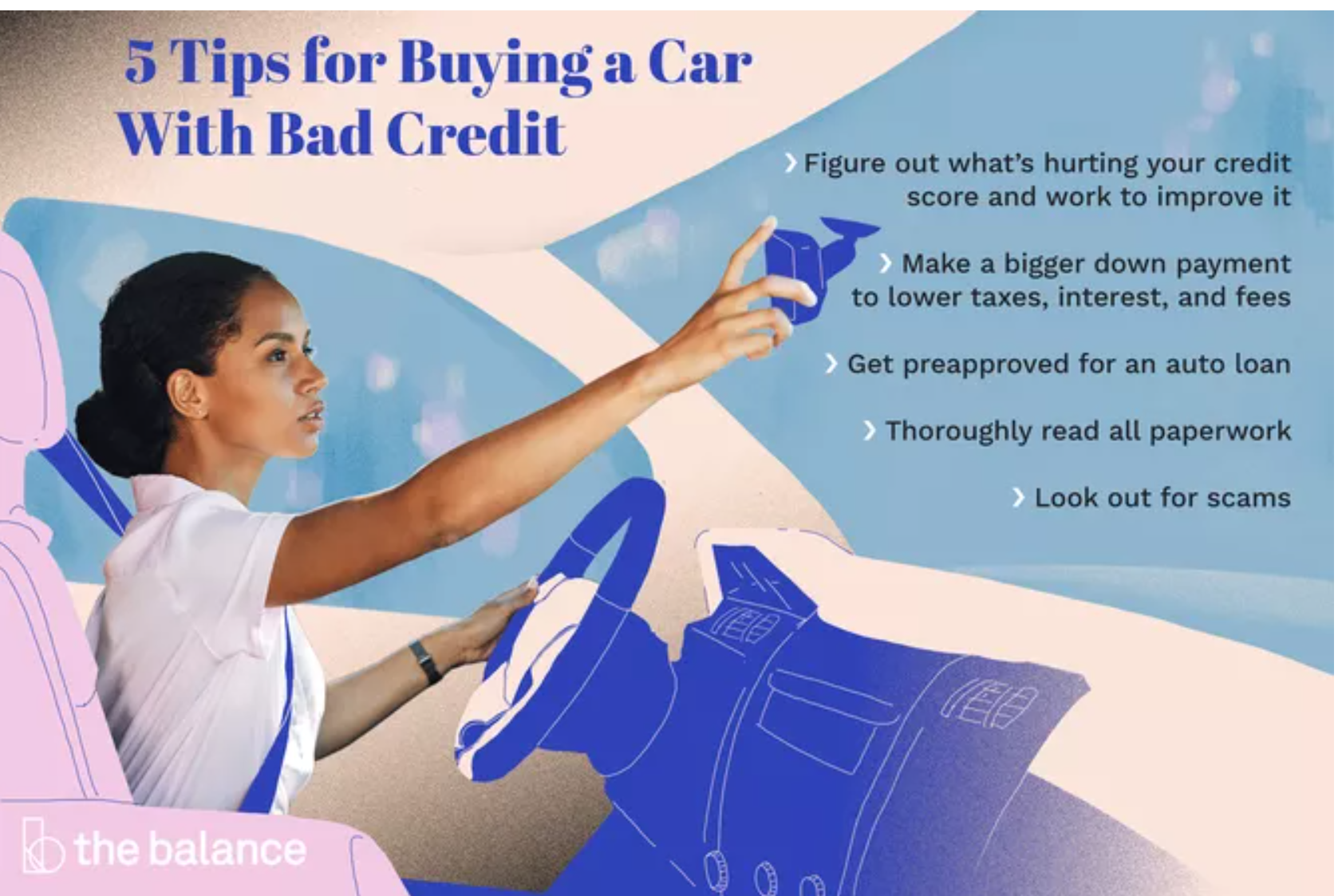

The moment you start thinking of purchasing a car, make a review of your credit report if possible several months in advance. When you eliminate every bad history in your credit, you will increase your chances of getting good conditions. The clean up of your credit includes: the previous down payment, debit errors in the credit report and adding positive information to the credit report.

Avoid extra bad credit items

Please keep the best behavior in the months following the loan application. At all times, make quick payments and do not take any major credit obligations, including new credit cards. Possible warning signs for the lender include late payment of rent, taxes, debt recovery, bankruptcy, taxes and lawsuits.

Check your current interest rates before buying a car with a bad credit.

Make an inquiry about the latest car loan rates online to have an understanding of what rate to expect. When you have bad loans you will have a higher interest rate. The interest rate will affect not only the monthly payment, but also the price of the car you can buy.

12 Great Tips for Buying a Car with Bad Credit – CreditNinja

https://www.creditninja.com › buying-car-bad-credit

Buying a new car with bad credit may be challenging. These 12 tips could help you increase the odds of getting approved for a car loan.

12 Steps Every Smart Car Buyer Needs to Follow

https://www.realcartips.com › newcars › 007-steps-ever…

Follow these 12 simple steps to maximize your savings when buying a new car. … Know your credit score and make sure to fix any errors that you find.

12 Tips for Negotiating With a Car Dealer

https://cars.usnews.com › Cars › Car Loans & Leasing

They could complicate your car purchase, make it more expensive, or eliminate your ability to lease a vehicle. If you do have bad credit, be …

How to Buy a car – 15 Essential Tips to Get the Best Deal

https://www.moneycrashers.com › how-to-buy-car-tips

Follow these tips for buying a new or used car, beginning well before you ever set foot in a dealership or complete your online vehicle purchase.

Make a higher payment in advance | tips for making purchases of cars with credit

Your credit history will reduce the amount of car loan you can get, and a high interest rate will make the amount even smaller. The advance can offset interest, fees and tariffs and expand the selection of vehicles that you can choose.

know what you can pay for.

Consider the money you have left after paying bills every month. Check your budget to find out what you can actually pay, and keep this amount, even if you get a loan agreement with a higher payment.

Obtain your prior consent.

You can make more purchases when you have a pre-approved loan amount to work. Confirm from the bank about how to get a car loan and learn about the initial approval process. If you can not obtain the consent of your bank, the seller of your car may contact a creditor who deals with buying cars with bad credit.

Skip the extras

You may not be approved for a large loan amount when you intend buying a car with bad credit. which may mean you have to give up some of the features. Leather seats, sunroof and premium speaker system can not be options when you try to buy a car with bad credit. You will already receive a higher interest rate. Do not increase this by adding features to your car.

Consult with non-profit agencies.

Before taking an expensive car loan, check if you have non-profit agencies that offer loans or vehicles to low-income consumers. Check the information on owning the vehicle

Be very careful about buy here, pay here | tips for making purchases of cars with credit

Buy here, pay here, automotive packages provide on-site financing with less credit ratings, but they’re well known for being big and using consumers. with bad credit. Get acquainted with the dealer’s recommendations and check the vehicle’s value and vehicle history.

Read all documents.

Credit documents can be confusing so it is important to have time to understand the terms of the loan. Make sure that the documents are in line with the distributor’s contract. If you agree to the terms, sign the credit documents before driving.

Do not buy a new vehicle with commercial expectations in a few years.

Car dealers can talk you into doing business with them in the future. When you do, the balance of the previous loan will be added to the new loan, and the payment will increase or the payment period will increase.

Beware of fraud | tips for making purchases of cars with credit

People with bad loans are subject to innumerable scams. Do not fall prey to such loans regardless of how much you want to be in a new car. These loans end badly for the car buyer and cause another stain on the already compromised credit history. No matter how desperate you are when it comes to a new vehicle, take your time, get all the data and make the best financial decision.