HOW TO FILE AND PAY BUSINESS TAX ELECTRONICALLY

IRS which is charged with the responsibility of enforcing tax regulations in the US has introduced the E-file program to facilitate its customers. This has helped taxpayers a lot to reduce the stress of going to the tax office to pay tax or file any complaints.

You must have encountered IRS if you are an adult of working age or you’re running a business in the United States.

In this article, you will learn How to File and Pay Business Tax Electronically. With E-file, you can pay and file tax return online; be it a Personal Tax of Business Tax Return.

With E-file, users are given multiple options for filing and paying their taxes depending on what suits them.

The Process Of Filing Your Taxes With E-File

When you visit the IRS site, you will find two options on how to file your taxes using E-File.

- You can go for tax preparation services like the popular TurboTax, TaxAct or H&R Block AtHome.

All the above-mentioned services are linked to the E-File service. You can as visit CPA or any other tax assistant firms so they can help sort your tax filing issues.

Filing and Paying Your Business Taxes – Internal Revenue …

https://www.irs.gov › small-businesses-self-employed

A secure way to pay your Federal taxes. Filing. Electronic Filing Options for Business and Self-Employed Taxpayers There are electronic filing

E-file for Business and Self Employed Taxpayers – Internal …

https://www.irs.gov › e-file-providers › e-file-for-busin…

Pay all federal taxes electronically – on-line or by phone 24/7. EFTPS is ideal for making recurring payments such as estimated tax payments and

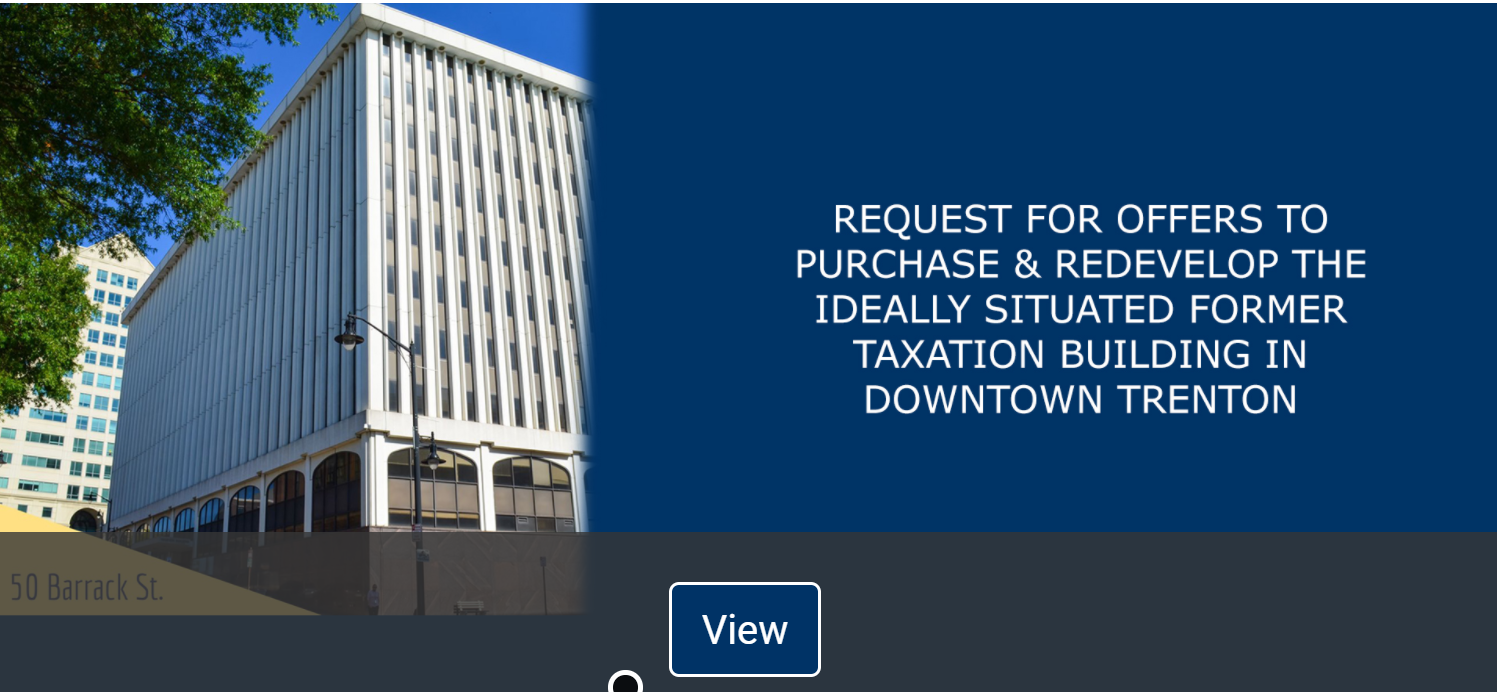

NJ Division of Taxation – Business Taxes and Fees

https://www.state.nj.us › treasury › taxation › onlinebus

Business Taxes and Fees ; Recycling Tax, Quarterly Return (RC-100). File or Pay Online; Online Filing: Worksheet and Instructions ; Sales and Use Tax/Salem Sales …

Lesson 3 – Filing and paying taxes electronically

https://www.irsvideos.gov › Business › SBTW › Lesson3

As a self-employed sole proprietor when you do file your form 1040 electronically you’ll complete a schedule C to report your business income and expenses.

How to Pay Tax With E-File | How to File and Pay Business Tax Electronically

There are two options for paying taxes when you are using E-File, they include:

- You can get your taxes paid through Electronic Fund transfer through your tax preparation software or through our tax professional. This is not applicable to those of Form 943 and Form 945.

- There is also the option of using your debit or credit card to pay. This is done through any of the designated IRS-approved Electronic payment places.

How to Pay Business Taxes Using EFTPS

If you are a business person, you can set up your Electronic Federal Tax Payment System (EFTPS) for business tax payment. This can be used to pay your business tax as well as that of your staff (Employee Taxes). EFTPS must be used for all payments that were initially filed with Payment Coupon 8109.

E-File W-2S with Social Security

There are lots you can do with E-File. E-File enables users to register with the Social Security Administration’s Business Services online. With the registration, you can file year-end tax reports and forms. This can also cover your W-2 and W-3 forms.

Seek A Professional Advice On How to File and Pay Tax Electronically

The process of paying business tax could be demanding especially for startup businesses. If you are having challenges with paying your tax as a business person or organization, it is better to seek for a tax professional out there. You can pay to learn the process so you can do it yourself the next year.

Understanding the processes involved in paying business tax for the first time can be challenging but with a little guide, you will be good to go.