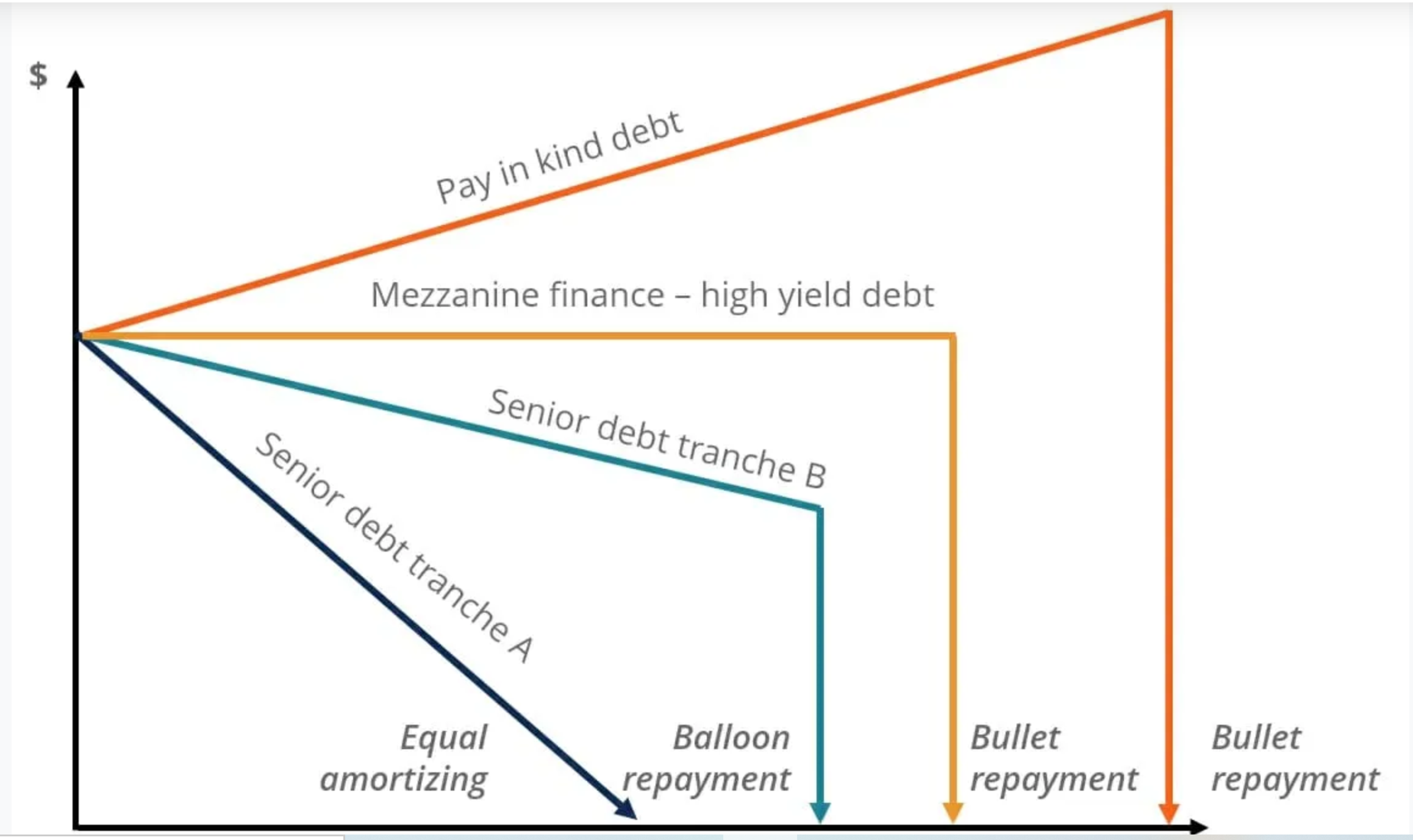

Bullet Repayment. One can choose to pay only the interest amount and the bulk amount can be paid later by the maturity of the loan or by the agreement of the financial institution. This scenario is regarded as a bullet loan. Typically, a bullet loan is also a lump sum payment made to cover an outstanding loan amount mostly by the due date. But this can also appear as a single payment of principal on a bond.

Over banking and real estate, Bullet repayments act as balloon loans. However, there are common mortgage and business loans so that the monthly payment will be lesser during the term of the loan. When a bullet repayment is made at the maturity of the loan, it should require proper advance planning to be able to refinance especially if the borrower does not have the cash to pay off the large lump sum.

WHAT YOU SHOULD KNOW

- Do you know that loans with bullet repayments? Will be used as a strategy to reduce monthly. Payments to paying interest-only during the period of the loan? But will attract a large final payment of principal eventually.

- Do you know that balloon lenders often times? Lend borrowers with the option to convert loans to. Traditional amortizing loans instead of attracting a huge and one at a time payment?

- Do you know those bullet repayments? Can be integrated with fixed-income, dependent on exchange-trade-funds? This helps investors to have bond-like predictability.

The Definition of a Bullet Loan – Investopedia

https://www.investopedia.com › … › Loan Basics

A bullet loan requires a large balloon payment at the end of the term, often used by real-estate developers when financing building projects.

Bullet Loan – Overview, Repayment Profiles, Advantages

https://corporatefinanceinstitute.com › … › Finance

A bullet loan is a type of loan in which the principal that is borrowed is paid back at the end of the loan term. In some cases, the interest expense is.

What Are Bullet Loans? – The Balance

https://www.thebalance.com › what-are-bullet-loans-51…

How Do Bullet Loans Work? With many types of loans, borrowers make principal and interest payments throughout the loan repayment period.

Bullet Payments: 3 Common Scenarios – Element Finance

https://www.elementfinance.com › terms › bullet-paym…

Also known as a “balloon payment” or “bullet repayment,” a bullet payment is a lump sum payment made for the entirety of the outstanding balance on a loan.

Bullet loan – Wikipedia

https://en.wikipedia.org › wiki › Bullet_loan

In banking and finance, a bullet loan is a loan where a payment of the entire principal of the loan, and sometimes the principal and interest, …

How Bullet Repayments Work

Know that neither bullet repayment nor. Balloon loans will not always be amortized mostly over the period of the loan. But there is a sure of full payment at the end of the loan period. The last or final payment is what. Really retires the loan and it is relatively larger than the. Other initial payments. The final balloon payment is regularly concluded with only the principal payment. Before the payment becomes due, the balance may. Be amortized over certain payment increments. Before the final balloon payment.

When the principal payment is deferred when the loan matures. This can be related to low monthly payments during the life of the. Loan because the payments are usually interest payments. This act can pose risk to borrowers who don’t have cash at hand to pay the principal or have any strategy to deal with the bullet repayment.

A borrower is left with two options

assuming money is not available to pay a loan in full at the point where he/she is to make the final bullet repayment. The first option is that the property could be sold and used to pay the loan principal or the loan can be refinanced (an act of taking out a new loan to cover for an outstanding loan over default or due) for the bullet repayment. Also, balloon lenders might grace the borrower to convert the loan to traditional amortizing loans instead of facing a one-time payment. This is applicable during the loan period.

Basically, the primary benefit of bullet repayment is that it states the return of principal over a précised date which makes it predictable for investors of sure repayment.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest