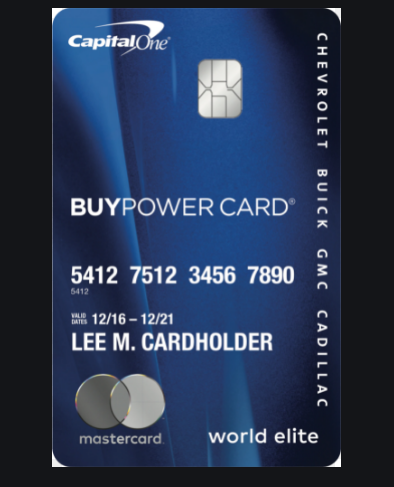

Did you recently get a pre-approval offer mail inviting you to apply for the BuyPower MasterCard? If you intend to buy a new General Motors vehicle in the future, just grab the offer. The Capital One BuyPower MasterCard will help you save a lot of money for the down payment of the vehicle. This is because the BuyPower MasterCard allows its cardholders to earn reward points that they can use for the down payment of brand new vehicle purchase or lease. Cardholders as well get complimentary upgrades on airlines, airport concierge, and trip cancellation insurance.

Features of the BuyPower MasterCard

- 5% earnings on the first $5,000 spent annually.

- Unlimited 2% Earnings on all other purchases afterward.

- There is no annual fee for the card.

- Points earned by cardholders do not have an expiration date, they can redeem them whenever they like.

- 0% introductory APR for the first year of card usage.

- After the first year, the APR is 11.90% to 19.90% depending on your creditworthiness.

- Cardholders can redeem their points for the purchase or lease of a new GM vehicle such as Chevrolet, GMC, Buick, or Cadillac.

5 Things to Know About the BuyPower Card from Capital One

https://www.nerdwallet.com › Credit Cards

The BuyPower Card from Capital One earns generous rewards, but you can redeem them only at GM dealerships for a new car, repairs or other …

Accept the BuyPower MasterCard – save lots of money for down …

https://logingit.com › Credit Card

The Capital One BuyPower MasterCard will help you save a lot of money for the down payment of the vehicle. This is because the BuyPower MasterCard allows its ..

Can the GM BuyPower Card Help You Save on a New Car?

https://www.thesimpledollar.com › Credit Cards

Feb 5, 2020 — The GM BuyPower card won’t let you earn new car per se, but it does let you saveup rewards to make a hefty down payment. How?

Capital One GM BuyPower Card Reviews – WalletHub

https://wallethub.com › Reviews › All Credit Cards

That’s worth about $790 per year to the average person, who makes roughly $32,010 in purchases that can be paid for with a credit card on an annual basis.

To apply for this card, go to

https://www.partnercardapply.com/splash/buypowercard. In the website, click on the Apply Now link to complete the application process. Enroll the 10 digit invitation number written on the pre-approval mail you got from Capital One. Answer other questions such as your Date of birth, full name, email and residential address, Social security number, annual income, employment status and some more questions. Once you finish the application, you will get an instant decision concerning your credit acceptance. If your application is accepted, they will send you your credit limit and you will get your credit card within 2 working days to your address.

After getting your card, go to the website above to register and activate it. To activate your card, call the customer care agent on the mail you got and follow the instructions you will receive. To register your card, go to https://www.partnercardapply.com/splash/buypowercard. Follow the steps below:

- Click on the Register Your Card link.

- Supply your full name as written on the card.

- Enter your card number.

- Supply the last 4 digits of your Social Security Number.

- Enroll your Zip code and your Card Security Code.

- Create a User ID and Password to always access your account.

- Click on Submit.

From now on, you can use your card to make purchases whether online or offline. You can as well access your online account and view your credit card details. Cardholders can as well make their credit card payments from their online accounts with so much ease.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest