There are various types of letters of credit even though five are commonly used. Each of them comes with different features and some are more secure than others. At other times, a letter of credit may combine two types, like ‘confirmed’ and ‘irrevocable’.

What is a Letter of Credit?

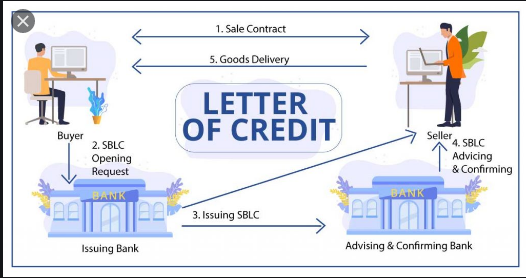

This is a financial document that is provided by a third party, who does not have a direct interest in the transaction. It is mostly a bank or a financial institution, that guarantees the payment of funds for goods and services to the seller once the seller submits the required documents. It contains three important elements namely: the beneficiary/seller who is the recipient of the LC, the buyer/applicant who buys the goods or services, and the issuing bank that issues the LC on the buyer’s request. At other times, there is an involvement of another bank as an advising bank that advises the beneficiary.

The Different Types of Letters of Credit – The Balance

https://www.thebalance.com › types-of-letters-of-credit-…

Standby Letter of Credit — Standby Letter of Credit. This type of letter of credit is different: It provides payment if something fails to happen.2 Instead …

Types of Letter of Credit (LC) – eFinanceManagement

https://efinancemanagement.com › sources-of-finance

A letter of credit has three important elements – the beneficiary/seller who is the recipient of the LC, the buyer/applicant who buys the goods …

Different types of Letters of Credit | TFG Ultimate Guide – Trade …

https://www.tradefinanceglobal.com › letters-of-credit

Different types of Letter of Credit · Revocable · Irrevocable · Confirmed · Unconfirmed · Transferrable · Un-transferrable · Straight · Negotiable.

Different Types of Letters of Credit – Emerio Banque

https://www.emeriobanque.com › blogs › different-type…

. Commercial Letter of Credit · 2. Export/Import LC · 3. Transferable Bank Credit Letter · 4. Non-transferable Bank Credit Letter · 5. Revocable …

Main types of LC ::: Letters of Credit – PASHA Bank

https://www.pashabank.az › lang,en

Main types of LC · 1. Irrevocable LC. This LC cannot be canceled or modified without the consent of the beneficiary (Seller). · 2. Revocable LC. · 3. Stand-by LC. · 4.

Why Use It?

Letters of credit are commonly in use when a buyer in one country purchases goods from a seller in another country. The seller may ask the buyer to provide a letter of credit in order to guarantee payment for the goods.

Thus the main advantage of a letter of credit is that it can give security to both the buyer and the seller.

Advantages of for Sellers

Sellers get reassured that they will receive their money in full and on time by asking for an appropriate letter of credit. An LC is one of the most secure methods of payment for exporters as long as they meet up with all the terms and conditions. Here, the risk of non-payment is transferred from the seller to the bank(s).

Advantages to Buyers

In the case of a buyer, this gives the buyer a guarantee that the seller will keep to their own side of the bargain and provide documentary proof of this.

Things to Look-Out For

Note that there are additional costs involved in using a letter of credit. Banks make charges for providing an LC, so it’s important to weigh the costs against the security benefits.

For exporters, you’ll only receive a payment if you keep to the strict terms of the letter of credit. You will have to give documentary proof that you have supplied exactly what you were contracted to supply. Note, however, that using a letter of credit can sometimes cause delays and other administrative problems.

The Different Types of Letters of Credit

Revocable

This is not very common because it can be changed or canceled by the bank that issued it at any time and for any reason.

Irrevocable

An irrevocable letter of credit cannot be changed or canceled except all the parties involved agrees. Irrevocable letters of credit offer more security than revocable LC.

Confirmed

A confirmed letter of credit is one to which a second bank. Mostly in the exporter’s country affirms its own undertaking that payment will be made. This LC is used when the exporter does not find the security of an unconfirmed credit Solid enough. Because of the issuing bank risk of political and/or. Economic risk linked with the importer’s country.

An irrevocable confirmed letter of credit does not only have the commitment of the issuing bank. But also has a binding undertaking that is given by the confirming bank to pay. When the documents are presented in accordance with the terms and conditions of the credit. Thus, a confirmed letter of credit offers more security than an unconfirmed LC.

Unconfirmed

An unconfirmed letter of credit is one that has not been guaranteed or confirmed by any bank other than the bank that opened it. Here, the advising bank forwards the LC to the beneficiary without responsibility or undertaking on its part but confirms its authenticity.

Transferable

A transferable LC is one that can be passed from one ‘beneficiary’ (one who receives payment) to others. These types of LC’s are commonly used when intermediaries are involved in a transaction.

Other Types of Letters of Credit

Standby

A standby LC, is an assurance from a bank that a buyer is able to pay a seller. The seller does not expect to have to draw on the letter of credit in order to get paid.

Revolving

A single revolving letter of credit can cover for several transactions between the same buyer and seller.

Back-to-back

Back-to-back letters of credit can be used when an intermediary is involved, but a transferable letter of credit is unsuitable.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest