Total Debt Service Ratio

Total debt service ratio (TDS) is a debt-service measurement technique used by financial lenders as a guide when deciding the percentage needed to cover your debt from your gross income. However, your TDS ratio is the percentage of your income needed to cover all of your debts

in calculating the TDS, lenders forget not to consider the property taxes, credit card balances, and other monthly obligations of the borrower to the ratio of income to determine whether or not to extend the credit. With this, you can find out for yourself (borrower) how much you can afford to borrow.

Total Debt Service (TDS) Ratio Definition – Investopedia

https://www.investopedia.com › … › Loan Basics

The total debt service ratio is a measurement that financial lenders use to give a preliminary assessment of whether a potential borrower is already in too

3 Ways to calculate the DSCR – Abrigo

https://www.abrigo.com › blog › 3-ways-to-calculate-th…

Perhaps the most traditional calculation for DSCR, this formula divides cash flow by debt service: DSCR = Net Operating Income / Total Debt …

Debt Service Ratio: What It Is and How to Calculate It

https://www.thebalancesmb.com › … › Glossary

The debt service ratio is one way of calculating a business’s ability to repay its debt. It compares income to debt-related obligations.

How to Calculate the Debt Service Coverage Ratio – Crefcoa

https://www.crefcoa.com › Knowledge Center

To calculate the debt service coverage ratio, simply divide the net operating income (NOI) by the annual debt. Commercial Loan Size: $10,000,000. Interest Rate: …

WHAT YOU SHOULD KNOW

- Do you know that the total debt service ratio is a lending technique/formulae used by mortgage lenders to determine a borrower’s capacity to pay back a loan?

- Do you know in the total debt service ratio, unlike the gross debt service ratio, includes housing and non-housing-related debts and obligations?

- A TDS ratio below 43% is typically necessary to obtain a mortgage, with many lenders adopting more strict levels.

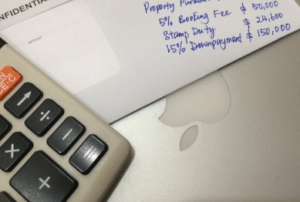

The TDS can be calculated and explained in simple terms from the below formulae

TDS = AMP + Property Taxes + ODP

Gross Family Income

Therefore,

TDS = stands for Total Debt Service Ratio, AMP = stands for. Annual Mortgage Payments, ODP = stands for Other Debt Payments.

Total Debt Service Ratio

A TDS ratio enables lenders to decide if a borrower will. Be able to manage and maintain monthly payments out of other. Expenses in order to repay the borrowed money. For instance, if you want to apply for a. Mortgage, lenders will have to look at the percentage that will be spent such as. Rents, real estate taxes, payments, and homeowner’s insurance and. Other obligation, from the borrower’s income.

It is also with the TDS that lenders figure out the portion of. Income already in use for paying credit card balance, student loans, child support, auto loans, and other debts outlined in the borrower’s credit report. This entails that not only a strong credit score, stable income, or timely bill payment serves as determinant factors extended in a mortgage.

Borrowers with higher TDS ratios may struggle with meeting u with their debt obligations compared with borrowers with lower ratios. This is because most lenders do not offer a mortgage to borrowers with. TDS ratios above 43% and prefer it to be 36% or even less. Thus, 44% is the. Maximum limit used by most lenders to qualify borrowers.

Difference between Total Debt Service Ratio and Gross Debt Service Ratio

The TDS ratio is similar to the gross debt service. Ratio but slightly different. The GDS does not consider housing-related payments e.g. credit card debts and more into the determinant factors. Borrowers should meet up to 28% or less for a gross debt service ratio.

In other words, the TDS AND GDS ratios are among the components considered in the underwriting process for a mortgage.