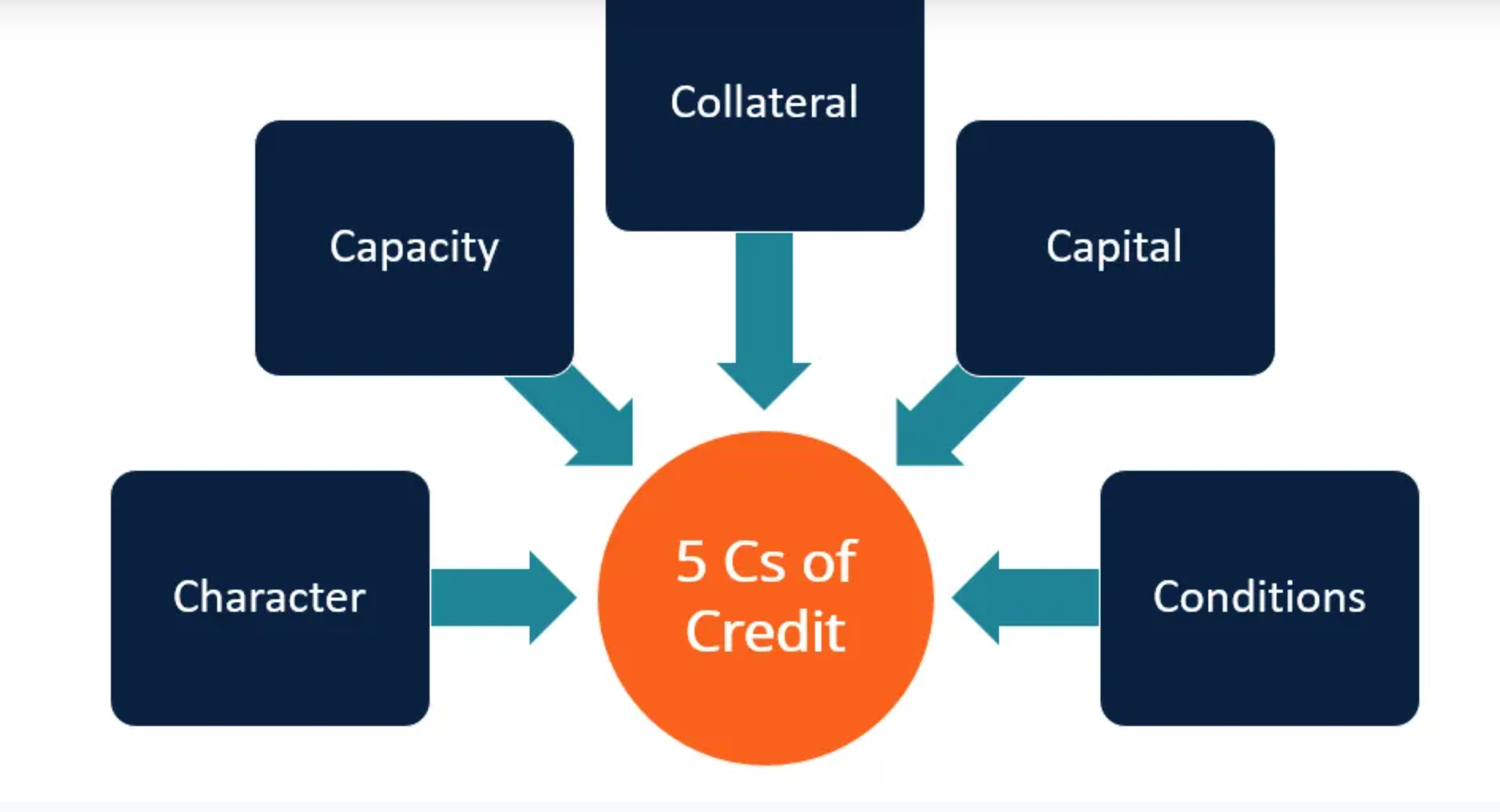

The five Cs of credit are a system whereby borrowers are measured of creditworthiness for potential qualification. The need for the five Cs is because the system makes use of five characteristics to measure and qualify borrowers over loan conditions. This is how the estimate is been done to figure out the chance of default and risk of financing. The complete equation for the five Cs of credit is represented as Character, Capacity, Capital, Collateral, and Conditions.

WHAT YOU SHOULD KNOW

- Firstly, the five Cs of credit is simply a considerable panel for checking and regulating financing over creditworthiness. These five Cs are based on questionable characteristics of the borrower.

- Secondly, the first C represents Character. Character is simply reflected in the applicant’s credit history.

- Also, the second C sorts for Capacity. This is based on the applicant’s debt-to-income ratio.

- Furthermore, the third C fights for the Capital. The sum of money the application has.

- The fourth C signs up Collateral. This handles the asset that is involved as collateral for the loan.

- Finally, the fifth C solves for Conditions. This stands in for the purpose of the loan, the sum of the amount involved, and the accrued interest rates.

5 Cs of Credit – Overview, Factors, and Importance – Corporate …

https://corporatefinanceinstitute.com › … › Credit

The “5 Cs of Credit” is a common phrase used to describe the five major factors used to determine a potential borrower’s creditworthiness.

Understand The 5 C’s Of Credit Before Applying For A Loan

https://www.forbes.com › advisor › credit-score › 5-cs-…

The five C’s of credit describe a borrower’s creditworthiness based on their character, capacity to repay the loan, available capital, economic

What Are The Five Cs of Credit? – Forbes Advisor

https://www.forbes.com › advisor › credit-score › what-…

The metrics lenders use to evaluate the creditworthiness of a potential borrower are often referred to as the Five Cs of Credit.

Master the 5 C’s of Credit – NerdWallet

https://www.nerdwallet.com › Small Business

The five C’s, or characteristics, of credit — character, capacity, capital, conditions and collateral — are a framework used by many traditional …

Five Cs of Credit

This is a system of evaluating the borrowers incorporative (basically qualitatively and quantitatively). This raised the need for credit report analysis, credit score, income statement, and some other important documents.

The Five Cs of the Credit (Character):

the character over here is related to the credit history of a borrower, simply the borrower’s reputation or track record for repaying debts. This is because both information is obtainable from the borrower’s credit reports. This information is generated by the three major credit bureaus which are, Experian, TransUnion, and Equifax. It shows the detail of the past borrowed activities of the applicant. If the applicant had challenges with the last reports. It will be clearly stated.

Furthermore, the report contains information on. Collection accounts and bankruptcies and information for. A maximum of seven years back. Under this stage of five Cs, lenders can also review for lien and judgment reports, seeking to assess the applicant’s risk over the loan.

Many lenders set minimum credit score requirements before an applicant is approved of a new loan. This minimum credit score varies. As lenders vary from each other. To exempt and attract quick accreditation of loans. Your credit score should be high. It is easier for lenders to relent on borrowers with good credit scores.

The Five Cs of Credit (Capacity):

Capacity regulates the borrower’s ability to repay a loan simply by. Comparing the income against the recurring debts. Also from the information on the borrower’s debt-to-income (DTI) ratio. DTI is calculated by lenders by adding the borrower’s monthly debt payments and dividing that by the borrower’s gross. To be favored by a loan, the applicant should have a low DTI to gain a better chance of qualifying for a new loan. As low as 35% DTI is preferable by some lenders while some prefer 43%. There is also an effect of having high DTI; consumers with high DTI are prohibited from receiving loans as well. Lenders examine the length at which an applicant has been on employment and future job stability.

The Five Cs of Credit (Capital):

The capital that initially was raised towards the investment. Will be assessed when obtaining a loan to fund a part of the project. If probably a larger portion of the capital put in place. For the investment was contributed by the borrower. This has a way to decreasing the chance of default. For instance, if you really want to receive a mortgage loan easier. Just have the capacity to place a down payment. Most mortgages especially those granted. By the federal housing administration and the U.S Department of Veterans. Affairs will require a borrower to at least have put down a down payment of. Between 2% and 3.5% on their homes.

However, the down payment is also a. Determinate factor that the borrower is severely serious. Down payment size can as well add. Some value or reduce the rates and terms of a borrower. That is to say, those larger. Down payments will attract better interest rates and terms.

The Five Cs of Credit (Collateral):

Collateral is what is used to secure a loan. This gives the lender an assurance of getting back his money or possessing. The collateral as expected when the loan defaults. Mortgages, for example. Are secured by homes. Loans backed-up are often referred to as secured loans or debt.

Thus, loans with collateral are less risky for lenders to issue. This employs the need for collateral to secure a loan. This will also attract low interest to. The loan and better terms, unlike the unsecured loans.

The Five Cs of credit (Conditions):

The conditions of the loan include the interest rate and. The amount of the principal. This really has an effect. To influence lenders to finance the borrower. How the borrower wants to use the fund is also. Part of the conditions that lenders look at and get influence to respond to funding. The specificity of the loan makes it easier for lenders to. Release funds to it. Unlike a signature loan that calls for no specification of use. More credit will be allocated to a consumer with plans to spend money such as a mortgage.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest