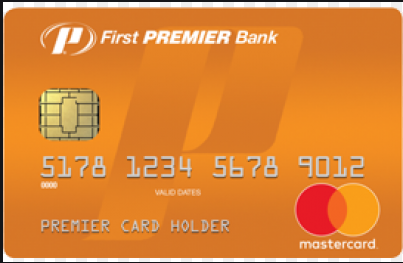

Do you currently have a First Premier Bank Platinum MasterCard? If so, you may have gotten a pre-approval offer through the mail from the bank asking you to apply for another card from them. If you got this mail, it means that they have found you creditworthy. The pre-approval offer is given to only customers who have proven that they are responsible and have maintained a good credit history for some time with them. You can decide to use the credit limit on both First Premier cards or decide to stop the other one or use the 2 platinum cards. It is up to the cardholder to decide what to do with the 2 cards and how to use them.

If you got the pre-approval offer and you need a. Second First Premier Bank Platinum Credit Card, you can apply for it. To do so, go to www.mysecondcard.net. Fill the online application form by supplying your personal. Details such as our full name, social security number, date of birth, zip code, employment status, income, and any other detail they may demand from you. Your annual income must be more than $10,000. Supply your current assets. When applying, supply the code written on the pre-approval letter you got.

After applying, submit the form

wait for a few seconds to know if you have been approved or not. If you get approved, they will send your First Premier Bank Platinum MasterCard to your residential address within 2 days.

PREMIER Bankcard® Mastercard® Credit Card Review

https://time.com › NextAdvisor › Credit Cards › Reviews

The PREMIER Bankcard Mastercard Credit Card* is an unsecured card option for people with no credit history or a bad credit score, …

Choose a Credit Card | PREMIER Bankcard

https://mypremiercreditcard.com › card-comparison

Compare the credit cards offered by PREMIER Bankcard/First PREMIER Bank. Find the right card for where you are in your credit-building journey.

First Premier Mastercard Review – Investopedia

https://www.investopedia.com › … › Cards for Bad Credit

The First Premier Mastercard offers an alternative to a secured card for those who have bad credit or no credit at all.

First Premier Bank Credit Card review – The Points Guy

https://thepointsguy.com › guide › first-premier-credit-…

This credit limit will be $300, $400, $500, $600, $700 or $1,000, depending on your creditworthiness. However, your annual fee will be deducted …

If you really need the card, apply for it before the expiration date. Applying for the First Premier Bank Platinum MasterCard after the expiration date will not allow you to get approval even if you are qualified for the card.

Also, you can apply through the mail by filling the acceptance form that came along with the pre-approval offer. After filling the form, send it through mail to the email address written on it. This process takes time for you to know about your credit acceptance since the mail takes time to reach the creditor.

After getting your card you will activate it and register it at the website above. To activate it, call the customer care agent number on the offer letter and follow the instructions he will give you. To activate your card, go to the website above and follow the following steps:

- Firstly, click on the Register your card link.

- Secondly, supply your full name as written on the card.

- Thirdly, enter your card number.

- The last 4 digits of your social security number.

- Enroll your zip code and your card security code.

- After that, create a User ID and Password. From now on, you will always be able to access your online account.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest