FICO 8 Credit Scoring Formula – What You Should Know

The FICO ( initially known as fair Isaac) score is well used by lenders. FICO updated its credit scoring model in January 2009 to improve in predicting if consumers will pay their credit bills. The new credit score FICO 08 which is the well known and used credit score in America, and has been chosen by the three major credit bureau: TransUnion, Equifax, and Experience.

You can check your FICO 8 score at myFICO.com

FICO 8 Credit Scoring Formula

What makes FICO 8 different from other FICO.

The FICO 08 takes a close look at certain groups of borrowers who lenders need more help with risk prediction. These borrowers are new borrowers, subprime borrowers and including those having few opened accounts, and borrowers looking for credit.

Borrowers will be given points for paying loan balance below the original amount. Under FICO 08, borrowers with various types of credit accounts such as auto loans, credit cards, and mortgage will be given high scores compared to those with only one or two types of accounts. But those whose loan balance is close or above the original amount will lose credit score points.

Under FICO 08, your credit score will not drop if you have a separate late payment when your other account is in good condition. In a situation, whereby you are behind on several accounts, you will notice a drop in credit on your credit score.

Avoid having a high credit utilization as this affects your credit score, then when you use only a small portion of your available credit. Also, do not close your accounts but leave it in good condition.

The “Nuisance” debt collection is for those with an original amount except $100. This can affect your approval for anything since it appears on your credit report, but you will not be punished by FICO 08 for these small collections.

What Is the FICO Score 8? – The Balance

https://www.thebalance.com › the-fico-8-credit-scoring-…

FICO Score 8 is a credit scoring model from the Fair Isaac Corporation (FICO) that is widely used by lenders to help determine the creditworthiness

What Does FICO Score 8 Mean? | American Express

https://www.americanexpress.com › … › Credit Score

The more you know about the FICO 8 scoring model, the more control you will have in building or maintaining an excellent credit score.

What Is The FICO Score 8? – Forbes Advisor

https://www.forbes.com › advisor › credit-score › what-…

The FICO Score 8 is the most common FICO score that lenders and banks use when evaluating credit applications. Here’s what you need to know …

The FICO® Score 8 credit-scoring model explained – Credit

https://www.creditkarma.com › Get More Advice

How do FICO® Score 8 credit scores differ from the scores you see on Credit Karma? FICO® scores aren’t the only credit scores you‘ll see.

Things That Does Not Change in FICO 8 | FICO 8 Credit Scoring Formula

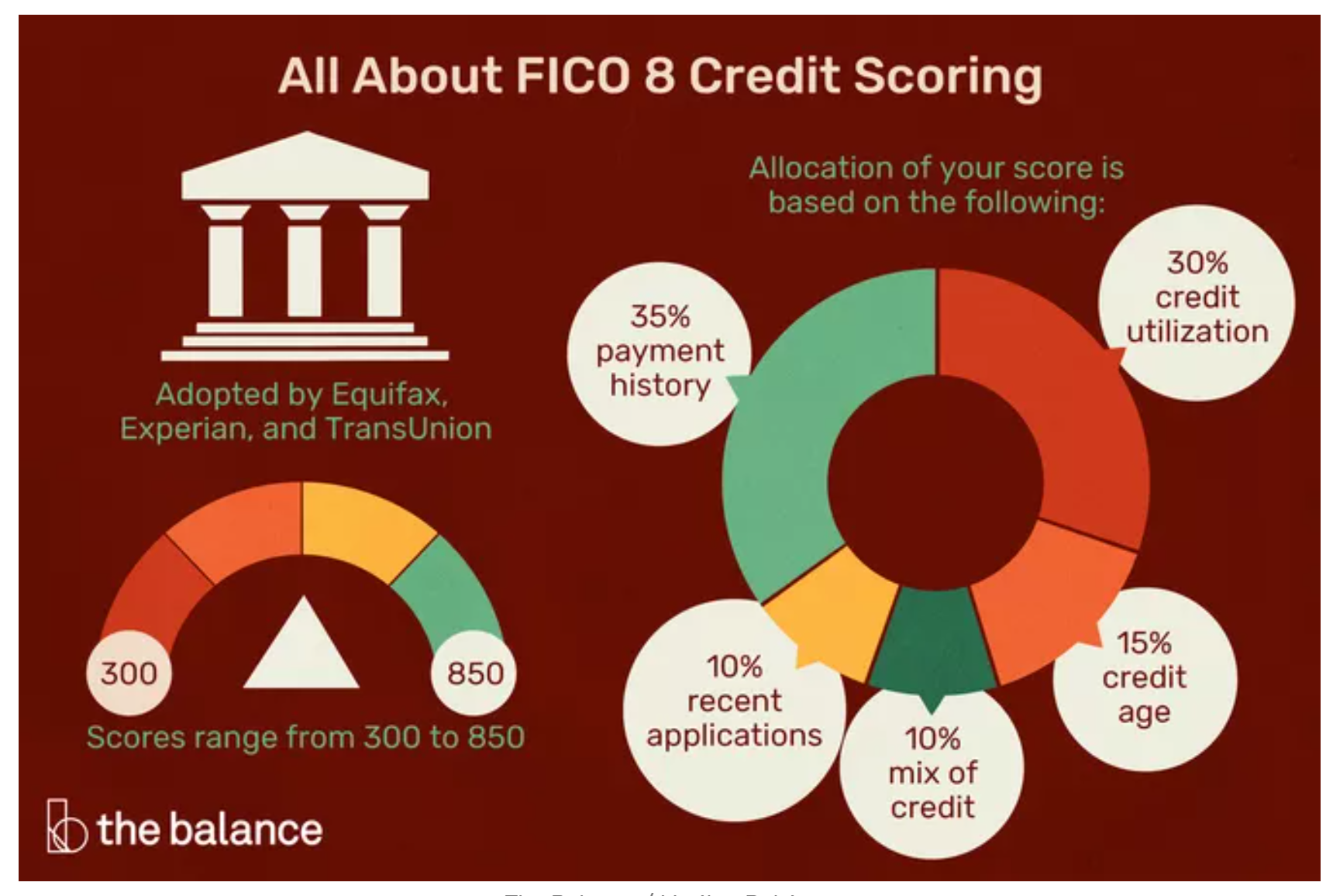

However, FICO 8 remains the same according to the scoring model. The FICO 8 score still range from 300 to 850 and higher score being improved.

It continually uses the same categories to calculate your credit score, that is:

- 30% credit utilization

- 35% payment history

- 15% credit age

- 10% mix of credit

- 10% recent application

The authorized user account will still be added to your FICO 8 credit score, but that of the new model will make a difference between the legitimate authorized user account and those that were purchased for credit improvement.

The information in your credit report from the three major credit bureau will determine your FICO 8 score.

Other Versions of FICO.

The latest FICO we have now is FICO 9, it was released early 2015. It does not considers paid collection and punishes consumers less for medical collection. This is an advantage to consumers, particularly considering the CFPB’s research that consumer credit score, unfairly suffered from medical collections.

These are the previous version of the FICO score: FICO 2,3,4 and 5. FICO also gives a Bankcard score for credit card issuers and an Auto Score for the auto lender. To see 19 of your FICO scores, just purchase the FICO Score 3B Report for $60 through my FICO. com.