You may be wondering how Credits Karmas makes money, relax we are going to take you all through that. But first, let’s take a look at what credits Karmas is and how it works, and what you stand to benefit from this online personal finance company.

What is Credit Karma?

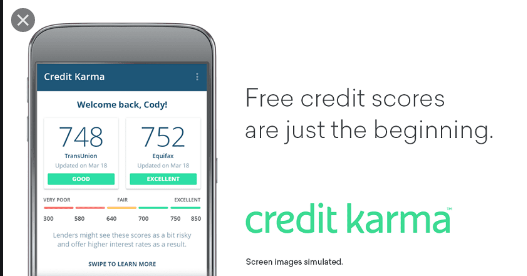

Credit Karma is an online personal finance company that offers free credit scores and also reports from the national credit bureaus like TransUnion and Equifax. Credit Karma enables its users to see changes to their credit score and inquiries and marks to their score.

This company also offers users tools that can help them monitor as well as improve their credit score, like offering individual financial recommendations, depending on a person’s credit profile. Right from its inception, Credit Karma has come out with different tools and services to benefit users with their credit monitoring and building.

How Credits Karma Works

Users of Credit Karma, have free, continuous access to their credit scores and reports from two of the main credit agencies, TransUnion and Equifax. You can sign up up for Credit Karma using their website creditkarma.com even if you do not register a credit card and with your basic information.

Here, members can track their credit scores as frequently as they like without having to pay for it. Also, Credit Karma offers many free online services and information to assist people in understanding their scores. If you become a member, you can find personalized suggestions, which can help in improving your credit scores, like how to reduce your credit use and increasing on-time credit card or loan payments.

What’s The Difference Between A Hard And Soft Credit Check?

https://www.forbes.com › advisor › credit-score › soft-c…

One type of credit check—a hard inquiry—could hurt your credit scores. The other—a soft inquiry—won’t affect those important numbers.

What Is a Soft Inquiry? – Experian

https://www.experian.com › blogs › what-is-a-soft-inqu…

A soft inquiry, sometimes known as a soft credit check or soft credit pull, happens when you or someone you authorize (like a potential

Hard Credit Inquiry vs. Soft Credit Inquiry | Credit Karma

https://www.creditkarma.com › Get More Advice

Hard credit inquiries could lower your credit scores by a few points. By contrast, soft credit inquiries won’t affect your scores.

What are soft credit checks and how do they affect your credit?

https://www.marketwatch.com › … › Credit.com

A soft credit check is when someone looks at your credit, either for informational or promotional purposes. Your credit score has impact on …

Pros and Cons of Credit Karma

Pros

- Firstly, credit Karma has great suggestions for fixing problem areas with your credit.

- Secondly, Credits Karmas is free to use.

- Thirdly, it has a favorable user experience.

- Also, this personal online finance company does an excellent job of explaining how credit scoring actually works.

- It pulls it’s data from third-party resources.

- Lastly, this online finance company also has great suggestions for fixing problem areas with your credit.

Cons

- Firstly, you get intrusive financial recommendations.

- It only shows you two of your credit scores.

- You can’t change the auto-logout setting.

How Does Credit Karmas Make Money?

Credits Karmas helps to make financial progress possible for you when you visit Credits Karmas. Here, you are shown personalized recommendations for financial products. If you happen to take one of these recommendations from the site, Credit Karma partners usually pay them. This could be the bank that issues a credit card you applied for or the lender of the personal loan.

Credits Karmas does not charge its members for the free credit reports. And credit scores it offers. Or for all the targeted advice they offer to members and they are quite transparent about it. How they make their money.

Unlike many other companies that would offer free services for personal information. Credit Karma does not sell you. Information to other companies instead, the information you provide is used to present you with targeted advertisements for financial services. Like credit card and loan offers.

As a member of Credits Karmas, you get shown credit card offers that you may likely be approved for depending on your credit score. Not only are you likely to be accepted, but you are also expected to get some benefits from the card offer, such as being able to transfer your balance from a high-interest card to a low-interest card.

So on the whole, Credits Karmas creates a win-win situation for everyone, where members get financial services they need, lenders get customers, and Credits Karmas on the other hand makes some money from the transactions.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest