Do you have a Capital One Credit Card? Are you looking for how to gain access to your Capital One Online account? If yes this article is for you. To access your online account, do the followings:

How to Access Your Capital One Online Account

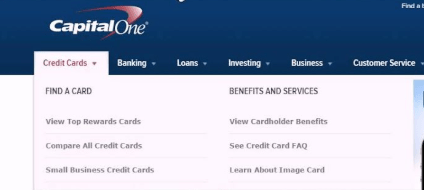

- Go to Capital Once Servicing Center or online web portal.

- Click on the “Need to Enroll“ option.

- Start the registration process by supplying your details such as your full name, date of birth, state of residence, and the last 4 digits of your social security number.

- Supply your personal financial information such as your income, employee details, and so on.

- Create your unique username and password. Now you can access your online account.

- In case you forget your Username or Password, click on the Forgot Username or Password link and follow the instructions given to reset your login details.

In case you get your monthly billing statement through mail, you can now switch to getting it online. This will save paper and as well as reduce tour stress.

It is even more convenient as you can easily read through the content of the statement when compared to reading some boring many-pages paper statements. From the Capital One online account, you can check your account balance, available balance, and history, make payments online, and check recent transactions, payment due date, and lots more.

Once you have an online account, you do not need to write checks and buy postage stamps to send your payments. You can easily make your payments through your account. This option as well saves all the time that travel mails take to reach Capital One. Your online payment is just a few clicks away and reflects on your account immediately.

In case you are likely to forget your payment due date, you can schedule an automatic payment. This initiates your payment at the same time monthly. It as well saves you from late payments and late payment fees. However, you must have money in the account that the payment will come from all the time to facilitate the transaction.

Moreover, you can make use of the account notification feature to remind you of payment due dates. These as well include email and text notifications to enable you to spend within your credit limit. Just click on the alert and messages tab to set this up by yourself.

It is very simple and easy to set up. In this case, there won`t be late payments and additional charges on your card. Prompt payment saves your creditworthiness and encourages lenders to be willing to lend you money. It can as well facilitate increasing your credit limit. There is nothing like using your credit wisely. Capital one has done everything to help you use your credit card wisely and conveniently.