Aspire Credit Card is an amazing Mastercard best for people with bad credit. The master card keeps you in control everywhere you go. It is an Unsecured credit card that is easy to qualify for. Not only that, it helps you build credit responsibly with on-time monthly payments.

Aspire Mastercard aspires to be the card you need to get out of debt. This card offers free credit scores to users, gives transaction alerts, has a simple and secure application process. Plus, $0 fraud liability, and granting online access 24/7 from any mobile device.

However, there are many things to benefits from the card. To take part in this benefits, you will need to apply. This write-up will give you guide on how to apply, login, activate and pay your card bills.

Aspire® Credit Card Review

Not to mention the Aspire Account Center lets you manage your credit account anywhere, anytime.

Simply make payments from any location, set up alerts, lock a lost or stolen card, check your account balances, and see the details behind every transaction you make.

Pros

It accepts all application credit scores

It allows credit limits up to $1,000

Offers great cashback rewards

Cons:

It’s expensive, unsecured card

Offers Annual and monthly fees

Comes with High-interest rates

Fees And Rates

The Aspire Mastercard is an expensive, unsecured credit card primarily used by people with bad credit. It has lots fees, including Annual fee and monthly fee. fees are associated with the card.

For the first year, it charges an annual fee of $85-$175 Afterward, annual and monthly fees, will be $29-$49 yearly and $7.25-$12.50 monthly.

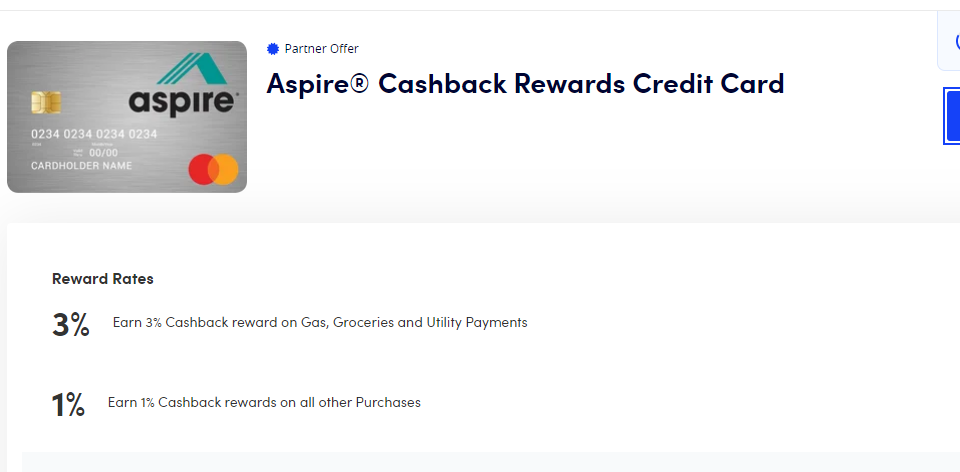

Rewards And Benefits

Get 1% cash back rewards on all purchases

Enjoy 3% cash back rewards on gas, grocery, and utility purchases.

Features and Benefits

- A 25-day grace period for borrowers every month.

- Link your card to your Apple Pay®, Google Pay™, or Samsung Pay®.

- No max over-limit fees

- No max penalty APR fees

- Reports to three Credit Bureaus

- Safely and responsibly build credit over time with on-time monthly payments.

- Free Credit Score

- Enjoy 24/7 Online Account Access:

- Pay your bills online with ease

- Set up alerts, lock or cancel a lost or stolen card, check your account balances

- View any transaction details online

- $0 Fraud Liability

Aspire Credit Card Application

Apply for Aspire Mastercard online, and enjoy easy and fast approval. To apply for the card you will need an acceptance code. You will receive the code on your along with the online application instruction sent to you.

What you need

Provide your employment details

Your email address

Your full name

Residential address

Mortgage and your period of employment

If you’re pre approved, you will get an acceptance code on your email. Then follow the directives below

- Launch your browser

- Go to aspirecreditcard.com/mastercard

- Enter your acceptance code

- Click on the “Submit code” tab.

Activate Card

To activate your card you need to register for online access. This will enable you to login to the platform, activate and manage your account.

Aspire Credit Card Login

Aspire Account Center gives you access to your account. It lets you manage your card anytime, from one place.

Login to your account and do the following

- Pay your bills

- Check account balances

- view payment activity and transaction details

- Set up notifications — and lots more.

- Access your accounts lightning-fast by using Fingerprint or Pin

- Check and monitor your credit score for free