Revolving credit vs installment Credit, what’s the difference?. Even though having both credits is important for a healthy credit score, you must understand that one can be more harmful than the other.

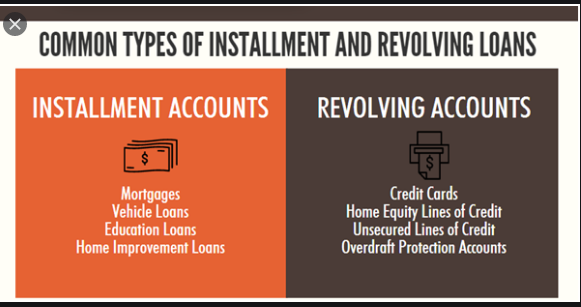

The two most common types of credit accounts are installment credit and revolving credit. Credit cards are classed as revolving credit. Revolving Credit Vs. Installment Credit can be understood in terms, of what your monthly payment is and how they both appear on your credit report.

Revolving Credit vs. Installment Credit: What’s the Difference?

Revolving Credit vs. Installment Credit: What’s the Difference?

https://www.investopedia.com › … › Credit & Debt

Revolving credit and installment credit are two fundamental types of credit, but how borrowers use and repay each type differs.

Revolving Credit vs. Installment Credit: What’s The … – CNBC

https://www.cnbc.com › select › revolving-credit-vs-ins…

Installment credit is a loan that offers a borrower a fixed, or finite, amount of money over a specified period of time. This way, the borrower knows upfront …

Revolving Credit vs Installment Credit – NerdWallet

https://www.nerdwallet.com › Personal Finance

Revolving credit can be used continually while installment credit is finite in its terms. Both impact your credit. Lindsay KonskoNov 13, 2020.

The Difference Between Revolving Debt and Installment Debt

https://www.upgrade.com › credit-health › insights › re…

Revolving Debt vs. Installment Debt. What is revolving debt? Credit cards are the most well-known type of revolving debt. With revolving debt, you borrow …

Installment Loans vs. Revolving Credit: What’s the Difference?

https://www.towerloan.com › blog › installment-loans-v…

Comparing installment credit vs revolving credit? We explain each, including how they affect your credit score, and which is better. ✓ Learn more here!

Installment Credit

This is a loan in which a borrower is offered a fixed, or finite, amount of money over a specified period of time. With this, the borrower knows upfront the number of monthly payments or “installments” they have to make as well as how much each monthly payment will be.

Apart from auto loans, installment loans also include student loans and mortgages. Note that, the repayment periods for such installment loans can last months or years based on the loan terms. You can choose a smaller monthly payment by consenting to pay for the loan over a longer time frame or make larger payments over a shorter term. Having to choose your repayment schedule is an advantage of an installment loan.

How Installment Loans Impacts Your Credit Score

Since each loan on your credit report is included in your credit history, it helps to have an installment loan where you can show a variety of credit accounts and to add to the longevity of your credit history.

It is also easier to budget for installment loans since the monthly payments are predictable. So long as you make your scheduled monthly payments for an installment loan on time, your credit score will definitely improve. This is because your payment history makes up 35% of your FICO score calculation, thus it’s important you do not miss a due date.

Revolving Credit

Revolving credit extends borrowers a line of credit with no determined end time. Here borrowers can spend up to their assigned credit limit. An example of revolving credit is a credit card. With a credit card, the cardholder routinely makes charges. Pays them off whether in full or partially, makes more charges, and so on…. The amount of money the borrower uses within their credit limit is decided. By them and there is no set monthly payment plan. Here, the borrower has the option of paying their balance off in full each month, or they can pay just the minimum and carry, or revolve their balance to the next month.

How Revolving Credit Impacts Your Credit Score

Revolving credit influences the calculating of your credit utilization rate, which happens to be the second biggest factor that makes up your credit score.

According to experts, it is ideal to borrow or use less than 30% of your credit limit. As you keep paying off your revolving balance, your credit score will surge up as you free up more of your available credit.

Revolving credits. Installment Credit: Which Should You Have?

In order to maintain a good credit score, it’s ideal to have both installment loans and revolving credit. However, revolving credit matters more than installment loans.

While installment loans (student loans, mortgages, and car loans) depict your consistency in paying back borrowed money over time. Credit cards (revolving debt) depicts that you can take out varying amounts of money every month and manage your personal cash flow to pay it back.

On the other hand, lenders are much more interested in your revolving credit accounts, according to Jim Droske, president of Illinois Credit Services.

Understand that, it is important to pay both bills on time each month. This is because on-time payments make up 35% of your credit score. However only credit cards show if you’ll be a reliable customer at the end of the day. Droske explains that this is because your balance is constantly in-flux. Credit cards demonstrate how well you plan ahead and prepare for variable expenses.

Which Impacts Your Credit Score the Most?

Note that credit card debt, even if it is paid on time, can have such a potentially negative impact on your credit score, but installment accounts are not treated in the same manner.

This is because revolving debt is much more predictive or indicative of elevated credit risk. Thus it’s going to be much more harmful to your credit scores.

Installment debt, on the other hand, is almost always secured, is a much less risky type of debt. Primarily because people are aware that if they stop making their payments, they stand a chance of losing their property.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest