You can tap into your home equity loan if you are looking for. Ways of making improvements on your home or thinking of. Ways of settling any financial issues you may have. This means you would be using the. Difference between what your home could sell for and what you owe on the mortgage as. A way of covering for the costs.

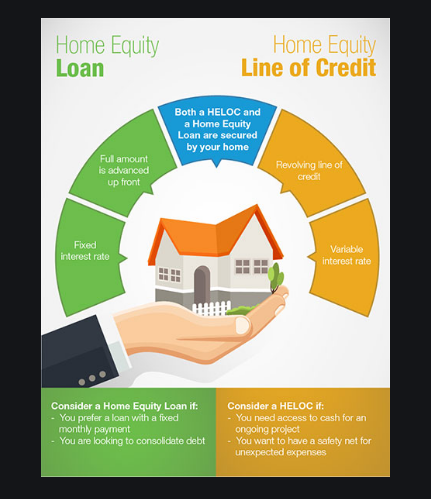

A home equity financing can be set up as a loan or line of credit. To have the lender advance you the total loan amount upfront. A home equity credit line, on the other hand, offers a source of funds. That you can draw on when the need arises.

If you want to take a home equity loan or credit line. It is best you shop around and compare loan plans which are offered by banks. Savings and loans, credit unions, and mortgage companies. Shopping around helps. Compare deals, to choose the one that best suits you.

What is Home Home Equity Loans / HELOC?

A home equity loan is a loan that is a fixed amount of money that you can secure using your home. The loan is repaid with equal monthly payments over a fixed term. Thus, your home secures the amount which you borrow via a home equity loan or line of credit. If there is a default in the payment of the debt, the lender may be able to force you to sell your home or foreclose on your home in order to satisfy the debt.

Understanding Home Home Equity Loans / HELOC

Normally, the amount you can borrow is limited to 85 percent of the equity in your home. When it comes to the actual amount you can borrow, there are things that come into play, they are; your income, credit history, as well as the market value of your home.

Before you pick a lender, it will be in your best interest to ask friends and family for recommendations of the lender, in order to get the best. Thereafter, you can shop and compare terms, by talking with banks, savings, and loans, credit unions, mortgage companies, as well as mortgage brokers.

HELOC pros and cons – MortgageLoan.com

https://www.mortgageloan.com › Articles › HELOC

Tax advantages — Getting a HELOC, or home equity line of credit, is a major financial decision. You need to decide whether to seek a loan in the first place

Advantages and Disadvantages of a Home Equity Loan – First …

https://www.firstalliancecu.com › blog › advantages-of-…

While home equity loans provide you with a lump sum of money, a HELOC covers short-term expenses. Taking out a home equity loan can bring

HELOC vs. Home Equity Loan: Pros and Cons – NerdWallet

https://www.nerdwallet.com › Mortgages

Home equity loans and lines of credit let you borrow your home’s equity. The loan is a lump sum and the HELOC is used as needed.

Home Equity Loan vs. HELOC: What’s the Difference?

https://www.investopedia.com › … › Home Equity

Home equity loans and home equity lines of credit (HELOCs) are loans that are secured by a borrower’s home. A borrower can take out an equity loan or credit …

Ask for clarification from the lenders you interview, to explain the loan plans available to you. Where you are in doubt of any of the loan terms and conditions ask for clarification.

The annual percentage rate (APR) for a home equity loan takes points and financing charges into consideration. You have to learn more about the fees, including the application or loan processing fee, origination or underwriting fee, lender or funding fee, appraisal fee, document preparation, recording fees, as well as broker fees, which may be quoted as points, origination fees, or interest add-on. Note that if points and other fees are added to your loan amount, you will have to pay more to finance them.

Before you sign on those dotted lines, ensure you read the loan closing papers thoroughly. If the loan is not what you bargained for, do not sign, rather negotiate changes, or simply walk away. You are also at liberty to cancel the deal for any reason without attracting any penalty within three days after signing the loan papers.

Home Equity Lines of Credit

Home equity line of credit also known as HELOC is a revolving line of credit, which is much like a credit card. It allows you to borrow as much as you need, when you need it, by writing a check or using a credit card linked to the account. You may not necessarily exceed your credit limit. This is because HELOC is a line of credit, you make payments only on the amount you actually borrow, and not on the full amount available.

Home equity lines of credit may also give you certain tax advantages unavailable with some kinds of loans. To get more details, you can talk to an accountant or tax adviser.

For HELOCs, you will be required to use your home as collateral for the loan. Now this, may put your home at risk if your payment is delayed or you can’t make your payment at all. Loans that come with a large balloon payment – which is a lump sum usually due at the end of a loan, may lead you to borrow more money to pay off this debt, or they may put your home at risk if you can’t qualify for refinancing, and if you happen to sell your home, most plans will require you to pay off your credit line at the same time.

Equity Loan Eligibility

Banks have guidelines and dictate how much they can lend depending on the value of your property and your creditworthiness, which is expressed in the combined loan-to-value (CLTV) ratio. Much like other mortgages, your eligibility for a loan and interest rate depends on your employment history, income, and credit score. Thus, the higher your score, the lower the risk you pose of defaulting on your loan, and the lower your rate.

Advantages & Disadvantages of Home Equity Loans / HELOC

As earlier stated, if you fall behind for a long enough period, because the lender has a lien on your home, there’s a possible chance of you facing foreclosure. Understand also that even if the property values stay flat or rise, every new loan stretches your budget.

Advantages

- You are at liberty to use the money for virtually any purpose.

- There is the safety of fixed interest rates on home equity loans.

- It has a lower cost than many other types of loans.

- There is access to borrowing a relatively large amount of cash.

- There are potential tax breaks if you use the funds on renovation projects that increase the value of your home.

Disadvantages

- If you use your home as collateral, you reduce the amount of equity in your home.

- In a situation where the real estate market takes a dip, those with higher combined loan-to-value (CLTV) ratios at risk of going ‘underwater’ on their loan.

Before you go for any lender, get as much information as you can on the said lender, to be on the safe side.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest