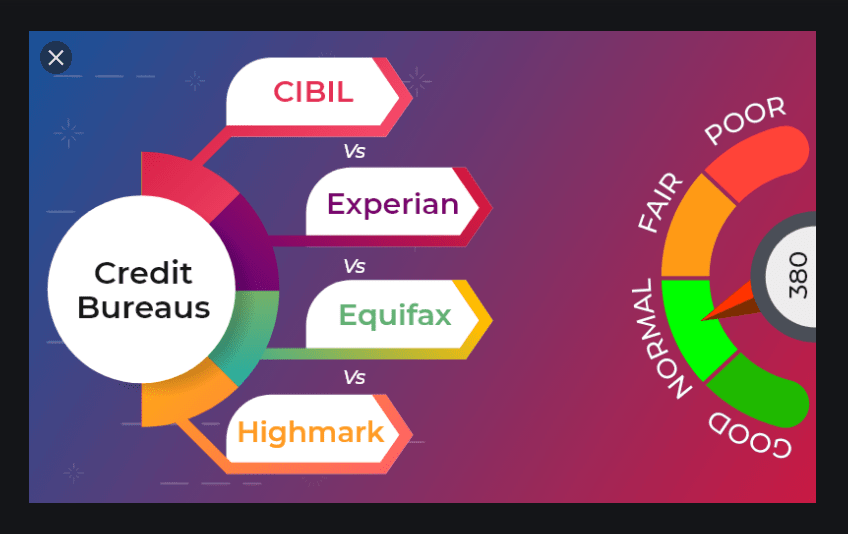

Experian VS Equifax what’s the difference? Experian VS. Equifax is credit bureaus that provide the information needed in calculating credit scores in the form of a credit report. These two credit bureaus do not actually calculate a score.

Rather, there are many different credit scoring formulas, known as “models”, from a number of companies including FICO and VantageScore. Why the scores differ is simply because the formulas used in calculating the scores are different, although the information used in the calculation is the same.

Not only do different credit scoring models weigh things differently, but they can also have different numerical ranges. Thus a score of 700 on one model may mean something very different than a score of 700 on another model. Experian VS Equifax is discussed below:

Experian VS Equifax

Experian

Firstly, Experian started out as part of TRW Information Systems and Services INC. in 1968. It has a long history of acquisitions and advancement.

Of all the three bureaus (Experian, Equifax, and TransUnion), Experian offers the most personal products for monitoring and protecting your credit.

FICO vs. Experian vs. Equifax: Differences Explained

https://www.investopedia.com › … › Building Credit

FICO, Experian, and Equifax all provide information about individuals’ credit history, but important differences exist between the three companies.

Equifax VS Experian VS TransUnion: 2021 Credit Bureau Guide

https://www.merchantmaverick.com › the-complete-gui…

The Complete Guide To Credit Bureaus: Equifax VS Experian VS TransUnion. Think of it like this: a credit report is a detailed report of what

Differences in Equifax, Experian and TransUnion Credit Reports

https://askthemoneycoach.com › what-are-the-difference

Here are the similarities and differences between the credit reports from the three major credit bureaus: Equifax, Experian and TransUnion.

Equifax vs. Experian vs. Transunion Complete Credit Bureau …

https://www.practicalcredit.com › Equifax-vs-Experian-…

In this article we’ve evaluated the credit monitoring and protection services, doing a side-by-side comparison of Equifax vs. Experian vs. TransUnion.

One good thing about Experian is that you can monitor your credit report from each of the three bureaus, thus you can have all your credit information in one place.

With Experian, you also have access to a FICO score simulator, which is invaluable for seeing what your FICO score could be if you make changes to your credit.

Products Offered by Experian

Personal credit monitoring and identity protection products and loan matching and credit card matching services are offered by Experian.

- Credit Report: With Experian, you can access your free Experian credit report at annualcreditreport.com.

- Experian Credit Report & Score: Buy Experian credit report and FICO credit score for $19.99. This purchase is only good for a one-time view.

- 3 Bureau Credit Report & FICO Score: View your Experian, Equifax, and TransUnion credit report and your FICO credit score for $39.99. This purchase is only ideal for a one-time view.

- Experian CreditWorks Basic: You can view your Experian credit report for free every month.

- Experian CreditWorks Premium: You can view your FICO score and gain access to Experian’s credit monitoring. Identity Protection, and credit lock services for $24.99 per month. This service includes the 3 Bureaus Credit Report. With this product, you can view your credit reports and credit scores daily. And it includes a FICO score simulator also.

- Experian IdentityWorks Plus: You can get Experian’s identity protection service at $9.99/month. And it also includes dark web surveillance, identity theft insurance up to $500,000. Lost wallet assistance, credit lock, and identity theft monitoring and alerts. It also includes credit monitoring for Experian and FICO score alerts. And you can also add child identity protection also.

- Experian IdentityWorks Premium: This is Experian’s most expensive identity protection service which goes for $19.99/month and includes dark web surveillance, identity theft insurance up to $1,00,000, lost wallet assistance, credit lock, and identity theft monitoring and alerts. It also includes credit monitoring for all three credit bureaus and FICO score alerts and you can also add child identity protection.

Note that for Experian CreditWorks and IdentityWorks products, you could earn a discount for purchasing an annual subscription instead of a monthly subscription.

Business Services

Experian offers business credit scores, even though they are not clear on the cost. The credit bureau also offers Experian Connect – a tenant screening service and Experian Mailing List Builder – a customer acquisition service.

Additionally, Experian offers 11 other business services ranging from customer management to risk management to debt recovery, consulting services, etc. You can log onto the Experian website to get more information about their business offerings.

Who is Experian Best For?

For individuals who are looking to view their Experian credit report or to actively monitor their credit report and credit score from all three credit bureaus.

Equifax

Equifax happens to be the oldest of the three credit bureaus. It has been in existence since 1899. The company has greatly evolved over the years, but its motto to “always focus on its customers” has remained the same.

Currently, Equifax offers basic credit report and credit score services and many other business products. The most notable aspect of Equifax is its “free credit lock service”, which allows individuals to safeguard their data without a fee.

Products Offered by Equifax

Equifax offers basic credit report and credit score services and a free credit lock service.

- Credit Report: With Equifax, you can access your free Equifax credit report at annualcreditreport.com.

- Equifax Credit Score: You can buy an Equifax credit score for $15.95. This score will be accessible for 30 days.

- Lock & Alert: This is a free service that allows individuals control over their credit report by locking and unlocking the report as required. There’s also a mobile app that sends alerts every time your account is unlocked or locked.

Business Services

Equifax grants you the liberty of purchasing a single business credit report for $99 or a multi-pack for $399.95. This can be used to view your own business credit or to ascertain the credit health of a potential business partner, supplier, or new customer.

Additionally to business credit reports, Equifax offers 11 products to help you in running your small business. These products range from customer acquisition to risk mitigation, credit monitoring, fraud prevention, and much more. You can log onto the Equifax website to get more information about their business offerings.

Who is Equifax Best For Experian VS Equifax?

Individuals who are looking to check their Equifax credit report and score and in need of a free credit lock service.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest