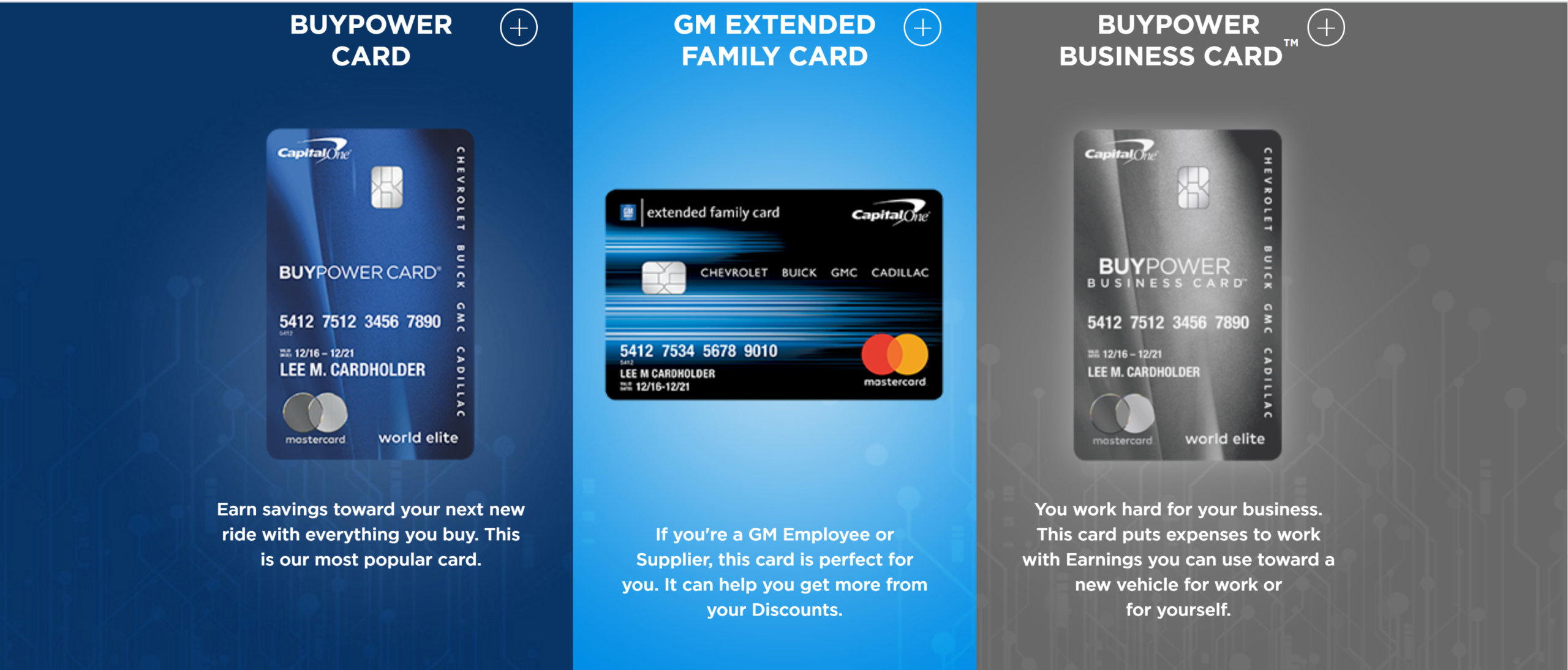

Are you about to buy a new car like Buick, GMC, Chevrolet or Cadillac? Why not apply for the Buy Power MasterCard from Capital One? The card permits its members to earn reward points and redeem them for buying a new car.

To help you spend less buying your dream car, why not apply for the card and take advantage of the reward points? To apply for the Buy Power Card, go to www.capitalone.com/applybuypowercard. The points you earn from using the card can help you make a down payment for your car.

2021 General Motors LLC – BuyPower Card

https://www.buypowercard.com › overview

Credit Cards. icon. BuyPower Card · GM Extended Family Card · BuyPower Business Card · Compare Cards. Popular Topics. icon. Current Vehicle Offers …

World Elite Mastercard Benefits | BuyPower Card

https://www.buypowercard.com › buypowercard › ben…

Every purchase made with your BuyPower Card comes with World Elite™ MasterCard® advantages. Call 1-866-602-6794 to learn more about your card benefits

FAQs | BuyPower Card | Capital One

https://www.buypowercard.com › buypowercard › faq

What is the BuyPower Card? The BuyPower Card is a credit card that rewards you with Earnings on every purchase you make, redeemable toward the retail purchase ..

GM Owner Benefits | BuyPower Card

https://www.buypowercard.com › gm-owner-benefits

As a Cardmember, you build Earnings you can use to save toward your next GM vehicle* with everything you buy. But there’s a world of other GM benefits …

Features of the Capital One Buy Power Card

- There is no balance transfer fee.

- No foreign transaction fee.

- There is no rotating category.

- 0% introductory APR for the first year.

- After the promotional period, the APR is between 13.15% to 23.1% based on your creditworthiness.

- Cardholders earn 5% cashback on the first $5,000 spent each year. This is equal to $250 added to the purchase of a new car.

- Once a cardholder spends more than $5,000, they will start earning 2% cashback on purchases.

- Cardholders can accumulate their reward points for the purchase of a new car. once you agree with the merchant on the price of the car, tell him you want to use your Buy Power Card to make the purchase.

To apply for the card online,

go to www.capitalone.com/applybuypowercard to complete the application process. Before you start applying, enroll the 10 digits invitation code on the mail you got and supply the last 4 digits of your Social Security Number. This will help you as you will also need to supply your other personal details such as your employment status, salary, mortgage details, and lots more. Once you make your online application, it takes only a few minutes to get a response concerning your approval. If you get approval for the card, you will receive how much your credit limit will be immediate.

You can as well apply for the card through the mail. This will take some time for you to know if you have been approved for the card, about 7 working days. You can as well apply by phone by calling the number in the mail and following the instructions the agent will give you.

After approval, you will get your card through the mail. Once you get your card, follow the following instructions to register and activate it.

However, to access your Card online account, you must register your card and activate it once you get it.

To register and activate your card, take the following steps:

- First, Go to the website listed above.

- Secondly, register your card and proceed to activate it.

- Also, click on the “Activate Your Card“ Link or Register button.

- Supply your account number and the credit card number.

- Enroll your date of birth.

- Supply your Social Security Number.

- Click on the Next button.

- Create your login credentials (Username and Password).

You can now gain access to your online account. After accessing your account, you can see your account balance, update your account details, enroll for paperless statements, use account alerts and notifications, make your monthly payments and even view your transactions both recent and past.