Average Auto Loan Interest Rates: 2020 Facts & FiguresThe average auto loan interest rate is always the second most expensive part of buying a car because most people take out a loan to purchase a car. Thus, it goes to say that, getting a good auto loan interest rate, can help you save tons of money.

Why is Some Average Auto Loan Interest So High?

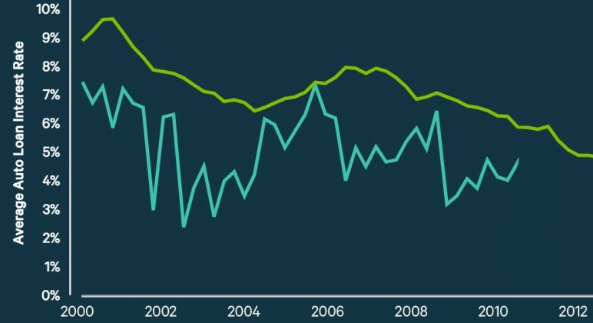

Auto loan rates are powered by two main factors, which are borrowing interest rates set by the Federal Reserve and your credit score. Thus, when the federal reserve keeps interest rates low, borrowing funds to purchase a car tends to be less expensive.

On the other hand, your credit score plays a major role in the car loan interest rate you have to pay. Those with a good credit score will qualify for a lower interest rate.

How it Works

If you finance a car, you borrow the amount of money you require to purchase the car, and the lender charges you interest. The interest is basically rent on the money you borrow, which enables the lender to make a profit and get back more of their money in case of a default on the loan.

How it impact on your auto loan interest rate

Average auto loan rates by credit score

Those with low credit scores are perceived by lenders as those who are less likely to pay back the money they borrowed.

Another factor that can also affect your auto loan rate, is the type and length of the loan. Used-car loans come with a higher interest rate than new-car loans. This is because used cars have a lower resale value than its newer counterparts.

Thus, if you default on a used car loan, the lending company will be left with a lower-value asset to sell which prompts them to charge more interest to safeguard themselves and recoup more of their money in the event where the loan goes into default.

Average interest rates by term length

Another factor that also affects your auto loan rate is the length of the loan you are acquiring. The longer the loan term, the lower monthly payments, even though it also means that you’ll be taking longer to pay the lender back. A higher interest rate, helps the lender recoup more of their money back upfront, in case you default on the loan.

Auto Loan Rates | Bankrate.com

https://www.bankrate.com › loans › auto-loans › rates

Frequently asked questions about auto loans — What are used car loan interest rates? Used car interest rates range from 3.68 percent to 19.85 percent

Current Car Loan Interest Rates | Bankrate.com

https://www.bankrate.com › Loans › Auto Loans

Get current auto loan rates and choose a loan that’s right for you ;

Average Car Loan Interest Rates by Credit Score – NerdWallet

https://www.nerdwallet.com › Auto Loans

The average auto loan interest rate is 3.64% for new cars and 5.35% for used cars, according to Experian’s State of the Automotive Finance …

Here’s the average auto loan interest rate by credit score, loan …

https://www.businessinsider.com › Personal Finance

The average new car’s interest rate in 2021 is 4.09% and 8.66% for used, according to Experian. Credit score, whether the car is new or used …

How to Get a Lower Average Auto Loan Interest Rates –Car Loan Interest Rates Lowest

If you seeking avenues on how to get a lower average auto loan interest rates, this few tips will help you:

Improve your credit score:This is one of the best ways to lower your car loan interest rate. Even though this may take a while, it will definitely pay off with time, as you pay your bills on time and lower your debt-to-income ratio. Once you get a better credit score, you will stand qualified for better auto loan rates, as well as save money on your car purchase.

Shop around:The second option with which you can get lower car loan rates is by shopping around for car loan rate quotes. Scout for quotes from multiple lenders, which will help you choose the one that helps you save more money. It will also get a pre-knowledge of what you should be paying in interest before you go to the dealership.

Opt for a shorter loan length:Thirdly, you can also save on your auto loan by choosing a shorter loan length or putting more money down on your car. This will, in turn, lessen the amount of money you have to borrow.